NLG Update – OUTPERFORM

25/12/2023 - 1:22:52 CHNAM LONG INVESTMENT CORPORATION (NLG VN)

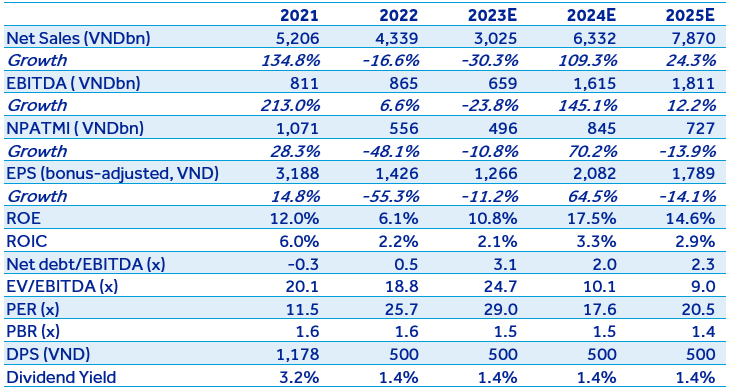

Adjust 2023 PATMI down by 15% to VND496bn (-10.8% YoY) because the 25% divestment of Paragon Dai Phuoc is delayed to 2024. Roll forward target price to VND42,212 at YE2024 and give an Outperform recommendation.

In 9M2023, Nam Long posted revenue of VND1,545bn (-43% YoY) and NPATMI of VND194bn (+62.7% YoY), equivalent to 51% and 33% of our forecast. The decline in revenue was mainly due to the lower number of units handed over at Southgate, Akari and Novia projects (323 units vs 813 units). The increase in the bottom line was mainly thanks to: (1) an increase in gross margin from 43.2% to 56.3% given the higher revenue proportion of Valora Southgate project, (2) higher profit from associates and joint ventures (VND205bn vs VND3bn) generated from the delivery of 890 units with a total revenue of nearly VND3trn at the Mizuki project and (3) higher deferred income tax (VND80bn vs VND35bn).

Sales performance reached the bottom in 4Q2022 and 1Q2023 and showed signs of recovery from 2Q2023 when interest rate fell and the market sentiment improved. Both Sales values in 2Q2023 and 3Q2023 declined compared to the same periods last year but recorded impressive growth compared to the previous quarter. Presales in 11M2023 was over VND3trn, equivalent to nearly 1/3rd of the company’s target, of which Southgate, Akari and Mizuki accounted for 43%, 42% and 15%, respectively. We expect 2024 presales to recover to nearly VND6trn (+50% YoY) with assumptions that interest rate will be stable at the current level and market sentiment will continue to improve.

In 9M2023, although net debt increased by over VND1.7trn, the company was still in a good financial position compared to peers. Net debt/Equity ratio rose from 3.1% to 16.4% but still lower than the industry median of 26.3%. Net debt/EBITDA rose from 0.5x to 3.0x but still lower than industry median of 4.3x.

However, we adjust 2023 NPATMI down by 15% to VND496bn (-10.8% YoY) because the 25% divestment of Paragon Dai Phuoc is delayed from 4Q2023 to 2024. We expect a strong growth in 2024 with estimated revenue of over VND6.3trn (+109.3% YoY) and PATMI of VND845 bn (+70.2% YoY) given delivery of Southgate, Akari, Mizuki, Izumi and Can Tho projects and 25% divestment of Paragon Dai Phuoc. Using RNAV method, we derive a target price of VND42,212 at the end of 2024 and give an OUTPERFORM recommendation for this stock.