IDC Initiation – BUY

12/04/2023 - 5:47:19 CHIDICO CORPORATION – JSC (IDC VN)

We issue a BUY rating with a target price of VND47,044/share for an industrial park developer with distinct power distribution income, healthy balance sheet and high cash dividend.

Originated as a state-own company under the Ministry of Construction (MoC), IDICO became the #4 industrial property developer in terms of market-cap with 10 operating industrial parks (IPs) covering a total land area of 3,267ha in the north and south regions, accounting for 2.6% of national market share. Five IPs are fully occupied and five are available for lease with remaining NLA of over 751ha at YE22.

Besides two hydropower plants Dak Mi 3 and Shrok Phu Mieng with a total capacity of 114MW, IDC currently has 100km of power distribution lines, two 110/22kV power substations Tuy Ha and Nhon Trach 5 with a total capacity of 418 MVA which generate average revenue of around VND2.5trn. IDICO may be one of the only two listed companies in the south, besides Saigon VRG (UpCOM: SIP), to have licenses issued by the Ministry of Commerce and Trade to build 110kV substations to distribute power directly to tenants which can yield a higher margin than that of other industrial property developers which are intermediary company between EVN and tenants.

Moreover, IDC has a stable income source from BOT An Suong – An Lac project which generates revenue of VND300-400bn/year with gross margin of ~50%.

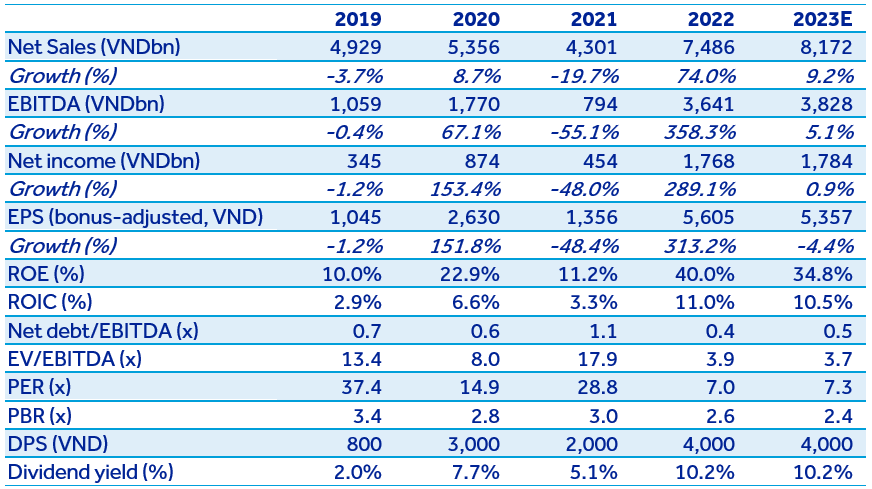

In 2018-2022, net revenue had a humble CAGR of 9% given 60-70% of total revenue in 2018-2021 came from stable power and BOT business lines. However, NPATMI had an impressive CAGR of 39% mainly thanks to a high gross margin of 41% in 2022 (resulted from a higher contribution from the industrial property segment given more industrial land area delivered and recognition of unearned revenue when changing booking method from annually to one-off) compared with 17-28% in 2018-2021.

For 2023, business result may go sideways with estimated net revenue of nearly VND8,200bn (+9% YoY) and PBT of VND2,677bn (+2% YoY) given no expected unearned revenue realized when changing booking method from annually to one-off. Using NAV method, we derive a target price of VND47,044/share and give a BUY rating for this stock given positive long-term outlook of the industrial property segment, solid income from power and BOT business line, strong financial status and high cash dividend of 40% which is expected to last till 2026. Major concerns for IDC include a slowdown in registered FDI and slow legal procedure of new projects and clearance process.