Three small regional banks in the US faced a liquidity crisis, UBS acquires Credit Suisse for $3.2 billion, raising concerns of a financial crisis similar to that of 2008.

23/03/2023 - 5:26:10 CHThree small regional banks in the US faced a liquidity crisis

Recently, several US banks have encountered liquidity issues, leading to concerns about a financial crisis similar to the one in 2008. Silvergate Bank, ranked 128th in terms of total assets in the US, faced its first liquidity hurdle as FTX, a cryptocurrency exchange, faced legal troubles. Then, Silicon Valley Bank, the 16th largest bank in the US in terms of total assets, experienced a liquidity crisis on March 10th and had to file for Chapter 11 bankruptcy protection on March 17th. Similarly, Signature Bank, ranked 29th in terms of total assets, had to cease operations and be taken over by regulators due to systemic risks on March 12th.

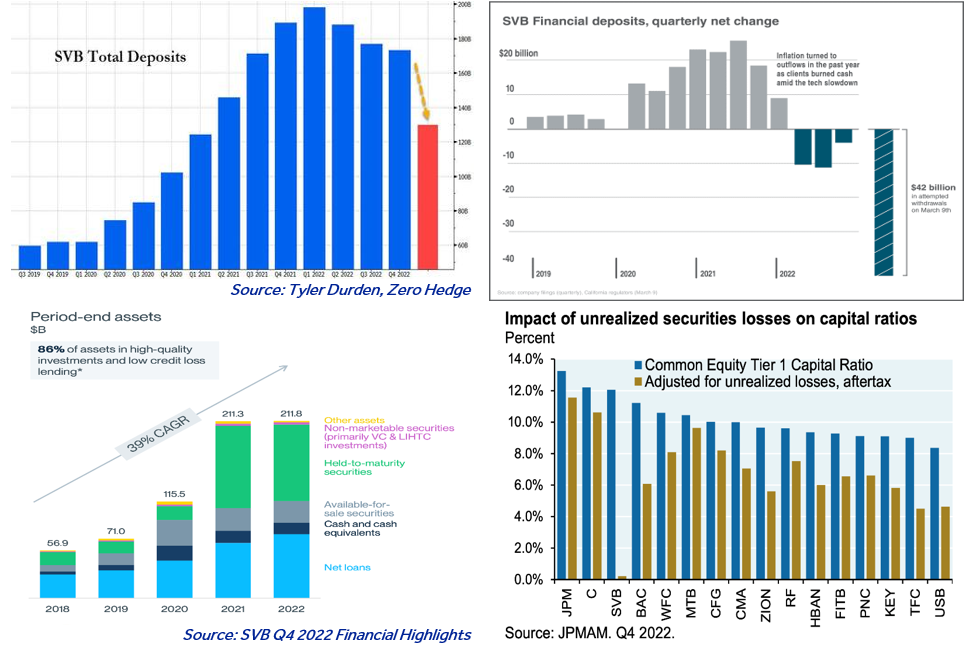

According to our observations, the recent liquidity crisis in some small US banks was caused by the Federal Reserve’s (FED) agressively increase of interest rates. This affected investment portfolios, including US Government Bonds, resulting in significant losses due to the previously low-interest rate environment from 2020-2021. The events at Silicon Valley Bank were also attributed to this low-interest rate environment. During this period, SVB raised substantial deposits, primarily from startups and speculation funds in the Silicon Valley area. Instead of lending out the majority of these deposits, SVB invested most of them in US’s Government Bonds (USGB) and mortgage-backed securities (MBS) with low-interest rates and longer terms than the deposit periods (accounting for nearly 65% of total assets). Thus, when customers withdrew their deposits, the bank had to liquidate these investment portfolios to ensure liquidity for depositors, leading to liquidity risks (when loan or investment asset maturities differ from deposit maturities). However, selling at significant losses resulted in interest rate risks (the price differential between loans or investment portfolios and bank deposits), potentially leading to losses exceeding shareholder equity. This situation further raised concerns among investors and depositors, leading SVB to spiral deeper into crisis and ultimately file for bankruptcy. Following SVB, Signature Bank faced a similar situation and was also temporarily forced to close.

Overall, the recent liquidity crises in several US banks serve as a cautionary tale for the potential risks of illiquid investment portfolios in low-interest rate environments.