MWG Update – BUY

09/03/2023 - 4:46:36 CHMOBILE WORLD INVESTMENT CORP (MWG VN)

Although we maintain a BUY recommendation on the stock, we revise down our projections to intensify caution about impacts from weak consumer spending power on the company’s growth in 2023.

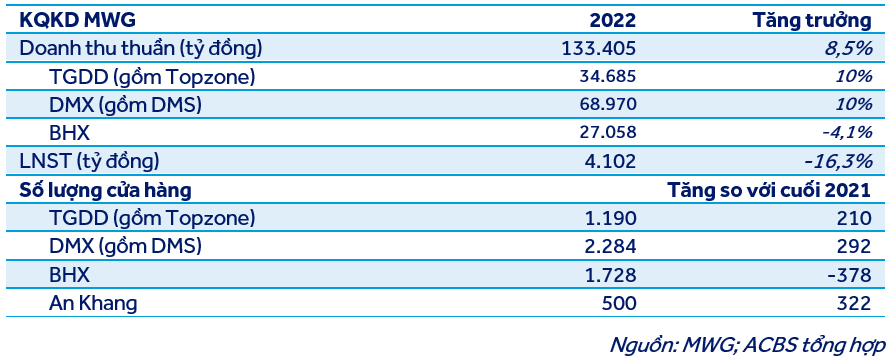

MWG announced net revenue and EAT slumped by 15.3% YoY and 60.4% YoY, respectively, in 4Q22. Although this drop was partially expected considering the high base in 4Q21, the results were exacerbated by weakening consumption, a surge of 92% YoY in interest expense and a higher SG&A expenses to net revenue ratio. On a cumulative basis, 2022 net revenue climbed by 8.5% YoY, meeting 98% of our projections, while EBT and EAT slid by 6.4% and 16.3% YoY, respectively, meeting 91% of our projections, largely attributed to:

I) a higher SG&A expenses on net revenue ratio (18.1% in 2022 vs 17.7% in 2021).

ii) financial profit shifting to negative VND69.5bn from positive VND573.2bn in 2021 due to a 102% YoY increase in interest expense, mostly given interest rate hike,

iii) c.VND500bn of expense from restructuring BHX chain.

iv) a higher effective corporate income tax rate (29.7% in 2022 vs 24.3% in 2021).

View details in the attachment below.