Initiation VIB – BUY

12/12/2023 - 2:58:50 CHVIETNAM INTERNATIONAL COMMERCIAL JOINT STOCK BANK (VIB)

We issue a BUY recommendation for VIB with a 1-year target price of 27,800 VND/share. Although business results are expected to face many challenges, VIB’s current valuation is quite attractive and can be improved thanks to the historical low interest rate environment.

Diversifying funding sources by mobilizing long-term capital from the interbank market and foreign financial institutions with lower interest rates than domestic mobilization helps VIB’s funding cost competitive to its peers, despite itsmedium-sized.

This, combined with focusing on lending to the high-yield retail segment, helps VIB achieve outstanding profitability. However, the decline in retail credit demand due to the sluggish real estate market will negatively affect the credit growth, NIM as well as profitability of VIB.

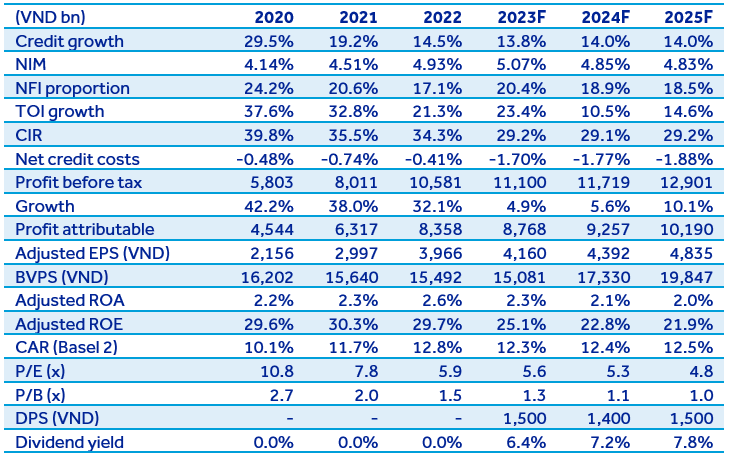

High risk appetite in the context of a difficult economy caused VIB’s overdue loans to increase sharply. By the end of Q3/23, VIB’s overdue loan ratio (NPL ratio combined with category 2 loan ratio) was at 10.13%, among the highest in listed banks. Asset quality deteriorated for 9M2023 and the provision buffer was quite thin, causing VIB’s provision expenses to remain high in the future. We estimate VIB’s credit cost in 2023-2025 will be around 2.0%, much higher than 0.6% in 2022.

Profit before tax (PBT) in 2023 and 2024 are expected to reach VND 11,100 billion (+5.6% y/y) and VND 11,719 billion (+10.1% y/y), respectively. Although business results are not expected to grow strongly when faced with many challenges, we think that the current valuation of VIB shares is quite attractive and can be improved thanks to the historical low interest rate.

We recommend BUY for VIB with a 1-year target price of 27,800 VND/share according to the residual income discount method (cost of equity: 17.6%, long-term growth: 5.0%). The above target price is equivalent to the 1-year forecast P/E and P/B of 6.3x and 1.6x, respectively.