DHC Flash note – BUY

01/11/2023 - 9:56:00 SADong Hai Joint Stock Company of Bentre (HSX: DHC)

DHC announced its Q3/2023 results with revenue reaching VND 795bn (-18.1% YoY), gross profit reaching VND107 bn (-15.1% YoY) and NPAT reaching VND 56bn (-12.5% YoY). Accumulated 9M2023, NPAT reached VND234 bn, completing 78.0% of the company’s 2023 plan and 68.8% of our initial projection.

Q3/2023’s revenue decreased by 18.1% YoY and decreased by 0.7% QoQ, reaching VND795 bn. We believe that the decline in sale prices, while sale volume mains stable, is the primary cause. For more details, the average Testliner price in Q3/2023 was $427/ton, (-10.3% YoY); and Medium price was $340/ton, (-23.1% YoY), as reported by Vietnamese Papar Pulp Association (VPPA).

Meanwhile, the costs of goods sold also dropped by 18.6% YoY. In particular, according to VPPA, the average price of old corrugated carton OCC 11 – USA for Q3/2023 was $181/ton, (-9.5% YoY); and OCC – Japan was $146/ton, (-24.7% YoY). Subsequently, the gross profit margin contracted marginally from 13% in Q3/2022 to 12.5% at present. For 9M2023, the gross profit margin was 16.0%.

Financial income and expenses are managed consistently in Q3/2023. Financial expense fell by 11.9% YoY, was VND12.2 bn. In contrast, interest expense hiked 74.4% YoY to VND8.5 bn, primarily due to increase of short-term loan to fund for daily operation activities.

In addition, the board of manager operates the company more efficiently as well on the grounds of being able to reduce selling and administrative expenses in Q3/2023, -14.6% YoY to VND25.9 bn and -12.2% to VND9.4 bn, respectively.

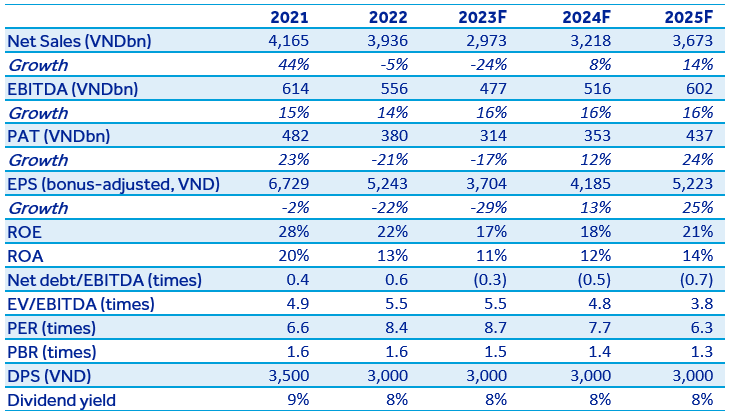

Quick comment: Q3/2023 business performance reached 78.0% of DHC’s plan and only 68.8% of our previous forecast. We lower the anticipated selling price of DHC’s output compared to the previous forecast, resulting in a decrease in gross profit margin of 2023 by 0.5%, to only 16.0%. Moreover, we project 2023’s NPAT will reach VND314 bn compared to VND340 bn in the last updated report. For 2024F, we reduce our profit forecast to VND353 bn for NPAT, +12.4% YoY. As a result, the valuation for DHC was revised down by 10.5%, to VND50,766 per share, representing a total expected return of 37.9% and reiterating BUY recommendation for DHC.