VRE Flash note – BUY

30/10/2023 - 11:29:24 SAVINCOM RETAIL JSC (VRE VN)

VRE posted positive result in 3Q2023 with revenue of VND3,333bn (+66.2% YoY) and PAT of VND1,317bn (+65.9% YoY) which were higher than our expectation. The company completed over 70% of revenue and profit targets in 9M2023.

High growth in 3Q2023 was mainly thanks to a nearly 10 times YoY jump in property sales, to over VND1.3trn from the delivery of 268 shophouses mostly at Dong Ha-Quang Tri project. Segmented gross margin was 44.3%, much higher than 15.3% in 3Q2022 as only 2 shophouses were delivered and 1 project was transferred at a very low margin in 3Q2022. As discussed with the management during the call, we expect the company to deliver around 100 units in 4Q2023, leading to property sales of over VND500bn in the last quarter.

In 3Q2023, leasing revenue increased by 8.2% YoY, to nearly VND2trn and leasing NOI increased by 9.0% YoY, to over VND1.4trn. Segmented gross margin was stable at 57.3% (+2.7 pp YoY and -0.5 pp QoQ). No new mall was opened in 3Q2023, thus the total operating malls was unchanged at 83 with total retail GFA of c. 1.75 mn sqm. Average occupancy rate was maintained at 85.4% (+1.5 pp YoY and -0.1 pp QoQ). The opening of VCP Ha Giang was rescheduled to 1Q2024, thus no new mall will be opened in 4Q2023.

Financial income rose by 2.3x YoY, to over VND300bn, mainly thanks to an increase of nearly VND4.6trn in cash and cash equivalent from 3Q2022 to 3Q2023.

During 9M2023, VRE lent over VND8trn to VinFast Trading and Production JSC and recollected the same amount in the period. During 9M2022, VRE lent over VND5.4trn to VinFast Trading and Production JSC and recollected VND5.7trn in the period. Per management, this is to utilize short-term surplus cash, earning interest rate at 11 – 12% p.a. which is significantly higher than average 3-month deposit rate right now. This is subject to the company’s policy on managing RPTs, whereby VRE can lend to sister companies to best utilize cash flow, provided that they are approved by the BOD, and total balance at any time cannot exceed 5% of VRE’s consolidated total assets.

For 9M2023, VRE posted total revenue of VND7,449bn (+42.6% YoY) and PAT of VND3,341bn (+71.9% YoY), equivalent to 72% and 71% of targets, respectively.

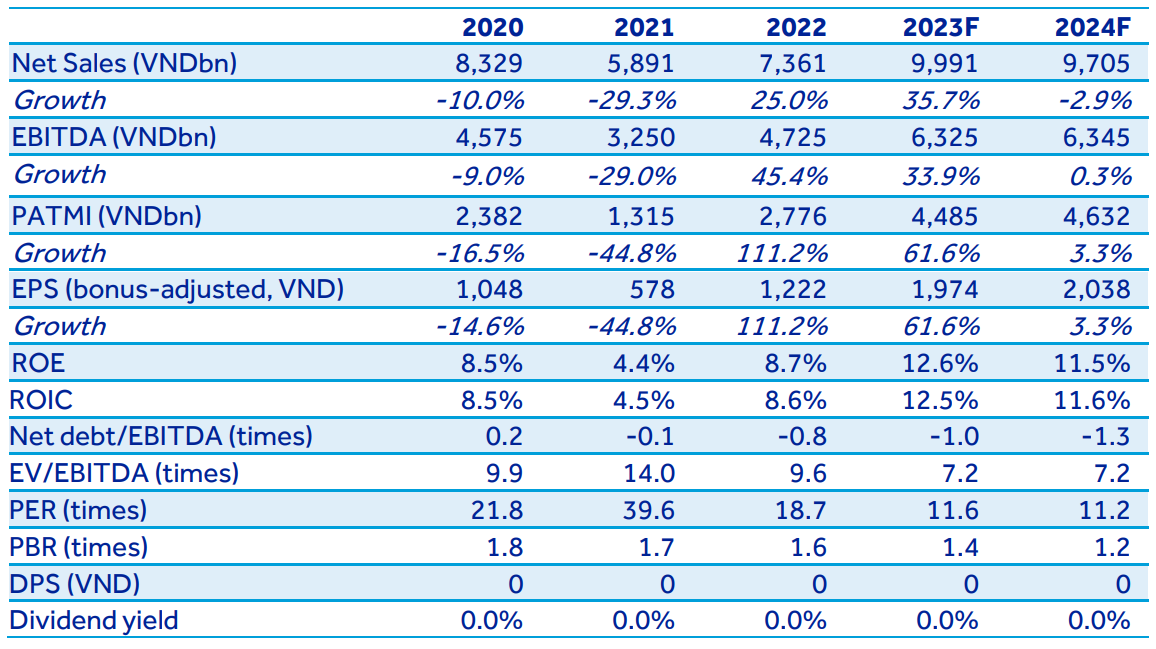

Quick comment: Given the delay in new mall openings, higher gross margins of leasing activities and higher loan amount to VinFast than our expectation, we revise 2023 revenue down by 2% to VND10 trn (+35.7% and net profit up by 16% to VND4.5trn (+61.6% YoY). For 2024, we forecast revenue at VND9.7trn (-2.9% YoY) and net profit at VND4.6trn (+3.3% YoY). We roll forward the valuation to 2024 and suggest a target price of VND34,884/share. Details of forecast and valuation will be updated in the upcoming report.