PNJ Flash note – OUTPERFORM

25/10/2023 - 5:16:59 CHPHU NHUAN JEWELRY JSC (PNJ VN)

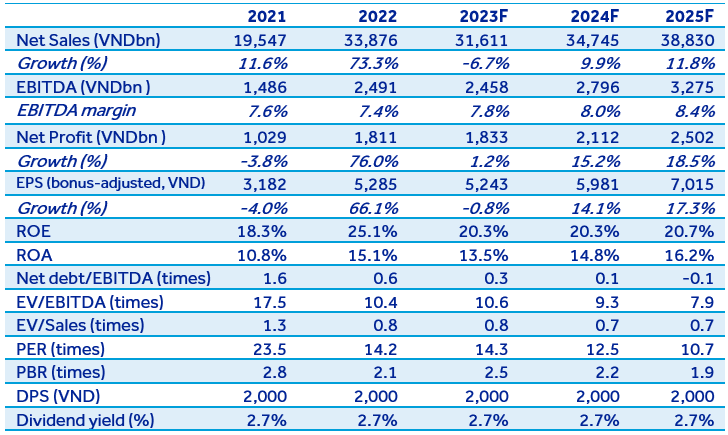

The company reported shaky y/y growth in 9M2023 in light of weak consumer spending, completing 69% of the company’s EAT target and 74% of our projections. The decline is expected to narrow in the last months of the year thanks to the year-end shopping and festival season. We projected the company may return to growth in 2024 given expectations about improvement in consumer spending. Rating OUTPERFORM and moving target price to 2024 at VND86,488/share.

PNJ announced 9M2023 revenue at VND23,377bn (-8.6% y/y) and EAT at VND1,340bn (-0.1% y/y), completing 74% of our full-year projections.

The retail segment’s revenue dropped by 10.5% y/y in 9M2023. The company estimated that this decline was lower than the average of the overall market (-40% in 9M2023, the company’s estimate). This was attributed to double-digit growth in the number of customers and the return rate of the existing customers reached the company’s target. The detailed numbers were not disclosed by the company. PNJ continued to introduce diverse designs & collections, reach customers through various methods and adjust marketing campaigns to be compatible with the current market conditions. By the end of September 2023, PNJ had 390 stores (YE2022: 364) in operation, including 378 gold stores (YE2022: 343). The wholesale segment plunged by 32.1% y/y while 24K gold sales increased by 5.9% y/y.

The company reported gross margin at 18.4% in 9M2023, compared to 17.4% in the same period last year, explained by cost optimization and exploiting new customers that bring higher margins, while the SG&A expenses to gross profit ratio climbed slightly to 59.9% vs 59.3% in 9M2022.

Inventories contracted by 7.6% compared to YE2022, to VND9,709bn. The net debt to equity ratio improved from 17% at YE2022 to only 1% at the end of September 2023.

Quick comment: Looking to 2024, we revised down slightly our forecasts for earnings by 5%. Specifically, our projections for PNJ’s net revenue and EAT are VND34,745bn (+9.9% y/y) and VND2,112bn (+15.2% y/y). Our target price for PNJ by the end of 2024 is VND86,488/share, equivalent to a total return of 18.3%. Further details will be given in the next update report.