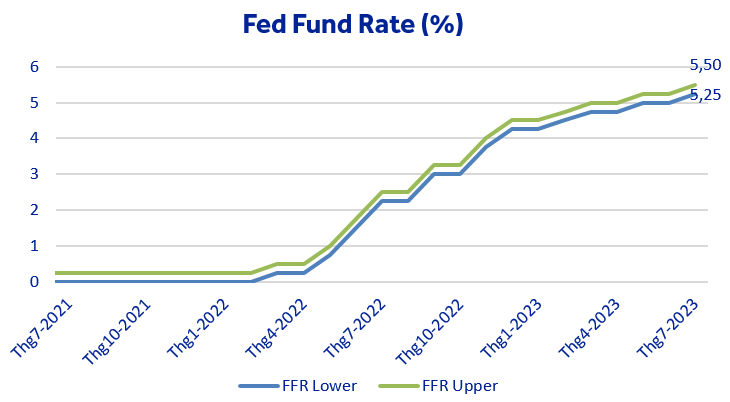

FLASH NEWS 27/07/2023: The US Federal Reserve (Fed) raised its interest rates by a quarter of a percentage point

27/07/2023 - 1:45:32 CHThe US Federal Reserve (Fed) raised its interest rates by a quarter of a percentage point bringing the Fed Fund Rate to 5.25% – 5.50% and has not signal of monetary tightening cycle ending.

At its meeting last night on July 26, 2023, the Fed raised interest rates by a quarter of a percentage point (0.25%), bringing the Fed Fund Rate to 5.25%-5.5% range, the level last seen in housing market crisis 2007 and the highest level for about 22 years, and will continue to crutinize additional information and the impact of interest rate increases on the economy. The US economy grew by 2% in the first quarter of 2023, better than the Fed’s forecast of 1.8%, and survey data show that the second quarter growth will be higher than previous quarter, combining with the unemployment rate remains low, reflect that The US economy is able to withstand the Fed’s tightening monetary policy. Although inflation has shown signs of weakening but Fed supposed that it will be a long way to bring the inflation to target without a recession, and the Fed is still open to the next options and has not shown any signs of ending the monetary tightening cycle and decisions can only be made on a meeting-by-meeting basis. Our analysts suppose that the US inflation is easing but challenged by the rising wages and the recovery of energy prices, and the Fed is taking a very cautious to determine with the inflation goal and avoiding the economy against recession while.