Flash News: DHC’s 2025 Annual General Meeting (AGM)

14/04/2025 - 2:17:46 CHThe AGM 2024 of Dong Hai JSC of Ben Tre (HOSE: DHC) took place on April 09, 2025, covering the following key topics:

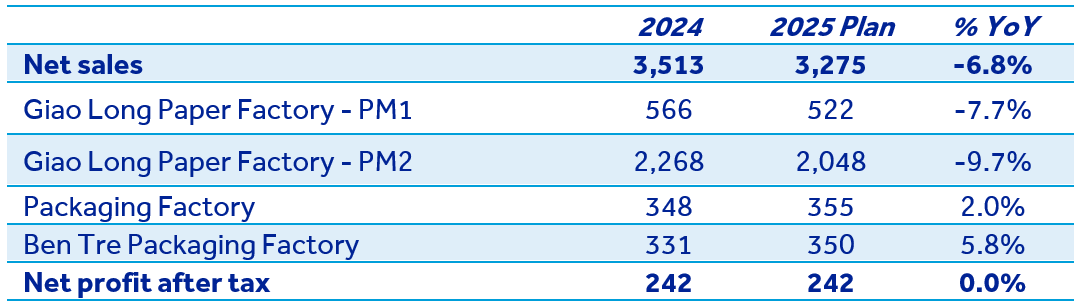

1. 2025 Business plan: Net sales is expected to reach VNDbn 3,275 (-6.8% YoY). Net profit after tax is estimated at VNDbn 242, equivalent to 2024. The detailed revenue from each factory is as follows:

2. 2024 Profit distribution: Dividends will be distributed to shareholders at a rate of 30% of charter capital from undistributed retained earnings as of 31/12/2024, of which 10% will be paid in cash (equivalent to VNDbn 80.5) and 20% in shares (equivalent to VNDbn 160.1).

3. CAPEX: The total investment capital for Giao Long Paper Mill 3 will be adjusted to increase from VNDbn 1,800 to VNDbn 2,250 (+25%), with a design capacity of 390,000 tons/year. Construction is expected to commence in Q4/2025 and begin commercial operations in Q2/2028.

4. Quick comment: We assess DHC’s growth outlook as neutral due to the following challenges:

(1) OCC paper – accounting for over 70% of production costs and mainly imported from the U.S., EU, and Japan – is heavily impacted by fluctuations in exchange rates and transportation costs, which could increase input costs and put pressure on gross profit margins.

(2) Paper demand may be affected as DHC’s key customers are export-oriented businesses targeting major markets such as China, the U.S., and the EU, which are currently facing risks from new tariff policies.

(3) Competitive pressure in the industry is intensifying, especially from domestic and FDI enterprises, making DHC’s market share and selling prices unstable.