PVD Update – Outperform

05/12/2023 - 1:30:23 CHPetroVietnam Drilling and Well Service Corp. (PVD VN)

PVD has announced positive business results for Q3/2023, with a NPAT-MI of VND150.5 billion (compared to a loss of VND33.7 billion YoY and -6.7% QoQ), in line with our expectations. accumulated 9M2023, NPAT-MI reached VND381 billion (compared to a loss of VND150 billion in 9M2022), fulfilling 381% of PVD’s annual plan and 67% of our full-year projection.

In Q3/2023, PVD recorded a revenue of VND1,381 billion (+11.2% YoY) and a NPAT-MI of VND150.5 billion, compared to a loss of VND33.7 billion in Q3/2022. This results attributed to the following factors:

- The increase of jack-up rig day rates by 33.8% YoY to 79,000 USD/day significantly contributed to this result. This development was attributed to the prolonged high crude oil price, which have stimulated demand for oil exploration and production activities.

- Additionally, in Q3/2023, PVD continued to record the remaining one-off profit of VND70 billion from the termination agreement of a drilling contract for PVD I rig with the client Valeura Thailand.

- The well technical services segment also showed good recovery with a 12.4% YoY increase in revenue and a gross profit margin rising to 28% from 24.5% in the same period last year.

These factors overshadowed the negative impact from 52% YoY increase in financial expenses, mainly stemming from foreign exchange loss of VND71.8 billion (+74.7% YoY).

With these results, PVD’s 9M2023 revenue reached VND4,033 billion (+2.8% YoY) and a NPAT-MI of VND381 billion (compared to a loss of VND150 billion in 9M2022), achieving 73% and 67% of our adjusted full-year projection, respectively.

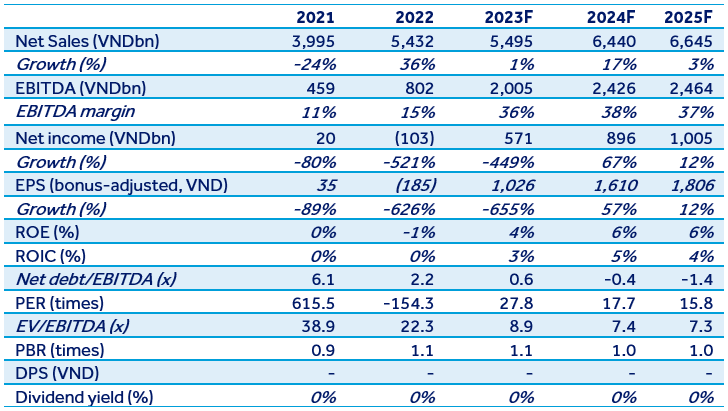

Quick comment: For 2023, we have adjusted our projected NPAT-MI to increase by 10% compared to the previous projection, reaching VND571 billion (compared to a loss of VND103 billion in 2022). The main reason for this adjustment is the higher increase in jack-up rig day rates for new contracts. Looking towards 2024, with the continuous increase in rig day rates, we project that PVD will achieve a revenue of VND6,440 billion (+17.2% YoY) and NPAT-MI of VND896 billion (+56.9% YoY). Using the discounted cash flow (DCF) method, our target price for PVD by the end of 2024 is VND32,000 per share, equivalent to a total return rate of 14.2%. Rating Outperform.