BSR Update – NEUTRAL

15/11/2023 - 3:27:11 CHBinh Son Refining and Petrochemical Company JSC (UPCoM: BSR)

BSR has announced positive business results for Q3/2023, with a NPAT-MI of VND3,260 billion (+581% YoY and +143% QoQ), exceeding our expectations. Cumulatively for 9M2023, NPAT-MI decreased by 51.8% YoY, achieving 200% of BSR’s annual plan and 78% of our forecast.

BSR recorded a revenue of VND37,755 billion (-4.6% YoY) and NPAT-MI of VND3,260 billion (+581% YoY and +143% QoQ) in Q3/2023, benefiting from low inventory cost during the upward trend of oil prices in Q3/2023, which increased from USD80.05/ barrel to an average of $94 per barrel in September 2023. Additionally, the crack spread, the difference between product prices and crude oil prices, also performed well in Q3/2023.

However, during this quarter, BSR also made a provision for inventory of VND821.7 billion to mitigate risks due to the average oil price in September 2023 dropping by 11% from USD94/ barrel to USD84/ barrel in early October 2023. Despite the ongoing risks associated with the Israel-Hamas war affecting crude oil supply, increased oil production by OPEC and the US, along with concerns about declining fuel demand, led to a more significant decrease in oil prices in October.

Although the Q3/2023 results were quite positive, overall, BSR’s business performance declined in 9M2023. The revenue for 9M2023 reached VND105,490 billion (-16.7% YoY), and NPAT-MI was VND 6,232 billion (-51.8% YoY), achieving 73.5% and 78% of our full-year projections, respectively. The decline in net profit for the 9M2023 was primarily due to a decrease in the crack spread compared to the higher levels seen in 2022, which was a record year of profit for BSR.

Regarding the plan of listing on HoSE, BSR is still waiting for specific guidelines from the State Securities Commission due to its subsidiary’s bad debts of more than 1 year. Therefore, listing on HoSE plan may be moved to 2024.

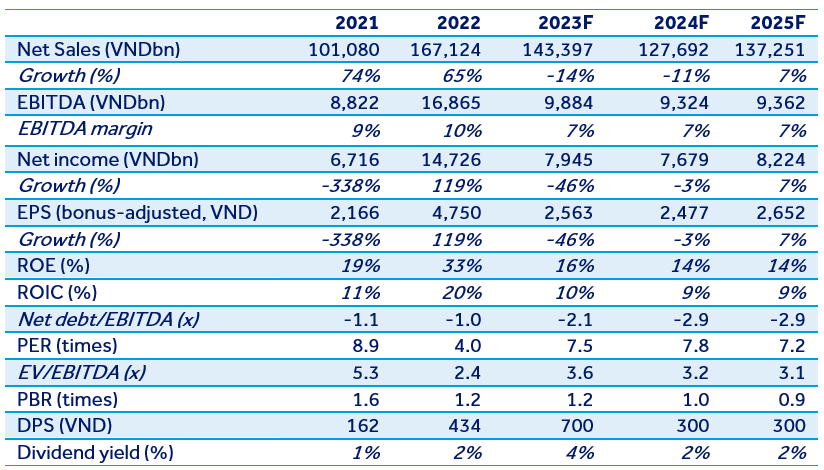

Quick comment: We have adjusted our forecast for BSR’s business results in 2023 and 2024, projecting a growth rate of 6.8% and 6% respectively compared to the most recent forecast. Looking towards 2024, we anticipate BSR to achieve a revenue of VND127,692 billion (-11% YoY) and NPAT-MI of VND 7,679 billion (-3.3% YoY). Our target price for BSR by the end of 2024 is VND 20,500 per share, equivalent to a total return of 8.4%.