DCM Flash note – OUTPERFORM

30/07/2025 - 11:38:49 SAPETROVIET NAM CA MAU FERTILIZER JSC (DCM VN)

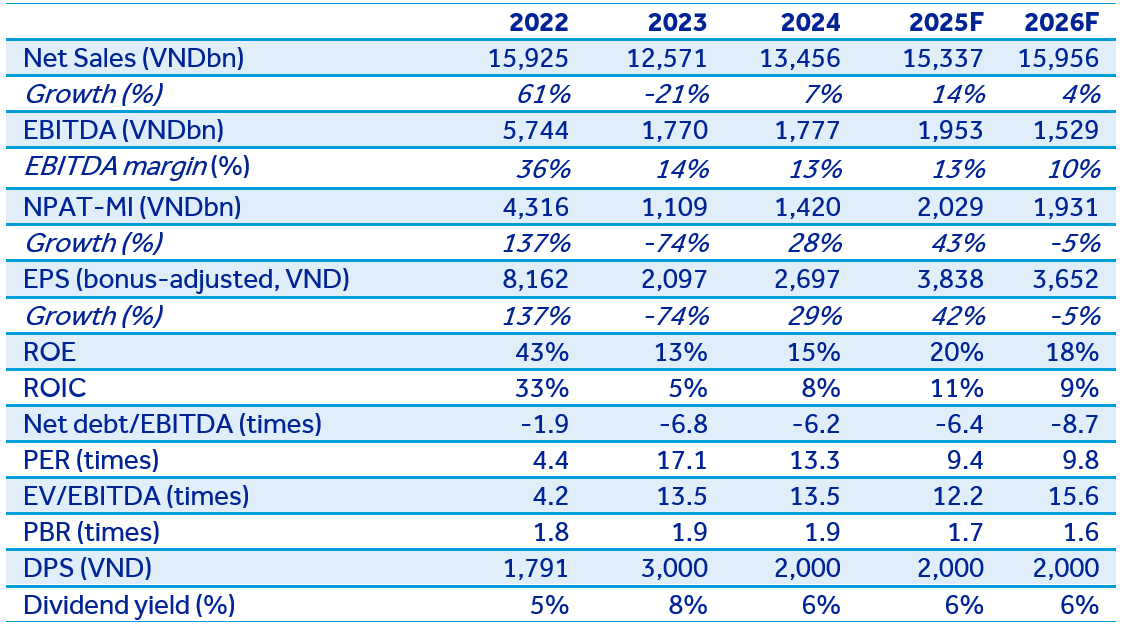

DCM announced Q2/2025 business results with NPAT reaching VND806 billion (+41.5% YoY, +95.7% QoQ), exceeding our expectations. For 6M2025, cumulative NPAT grew by 30.3% YoY to VND 1,218 billion, achieving 157% of the company’s full-year plan and 82.3% of our pre-adjustment forecast. We raise our 2025 forecasts for revenue to VND15,336 billion (+14% YoY) and NPAT to VND2,032 billion (+42% YoY), up 9.5% and 37%, respectively, from our previous estimates. Our target price for DCM is VND40,000/share by the end of 2025. OUTPERFORM.

DCM reported Q2/2025 revenue of VND6,037 billion (+56.3% YoY) and NPAT of VND806 billion (+41.5% YoY). This growth was driven by:

- Urea sales volume increased by 17.1% YoY, thanks to an 80% YoY increase in export volumes, while domestic urea sales volume slightly declined by 0.6%.

- Selling price of urea rose by 13.4% YoY.

- NPK revenue increased by 52.3% YoY, driven by a 49.7% YoY rise in NPK sales volume.

- Lower input gas prices, due to a 19.7% YoY drop in Brent oil prices.

SG&A expenses rose by 37.7% YoY to VND 401 billion. However, as a percentage of revenue, this ratio decreased to 6.7% from 7.5% in the same period last year. Moreover, the increase in NPAT would have been even higher if the VND167 billion in profit from the acquisition of KVF in Q2/2024 had been excluded.

For 6M2025, revenue reached VND9,444 billion (+42.9% YoY) and NPAT was VND 1,218 billion (+30.3% YoY). The growth was mainly supported by urea/NPK sales volumes surging by 3.9%/68.8% YoY and average urea selling price up by 7.8% YoY.

Outlook

With Brent crude oil prices forecast at USD68/barrel in 2025, down 15.5% YoY, we expect input gas prices to decrease by only 5% YoY due to a gradual reduction in cheap gas supply. Meanwhile, we revise our urea selling price forecast upward by 3% YoY, based on positive developments in 6M2025. Although China resumed urea exports at the end of May 2025 with a quota of approximately 2 million tons for the May–Oct 2025 period, the impact is expected to be only mildly negative, as Chinese fertilizer producers are still subject to quotas and cannot export freely. In addition, as VAT input tax refunds starting in July 2025 will further support NPAT growth, we raise our 2025 forecast to VND15,336 billion in revenue (+14% YoY) and VND2,032 billion in NPAT (+42% YoY), up 9.5% and 37%, respectively, from our previous projections.