Vietnam Strategy – 4Q22

29/09/2022 - 10:37:32 SAVietnam’s economic performance shines in the first half of 2022, while the equity markets navigated a stormy period in the face of global headwinds

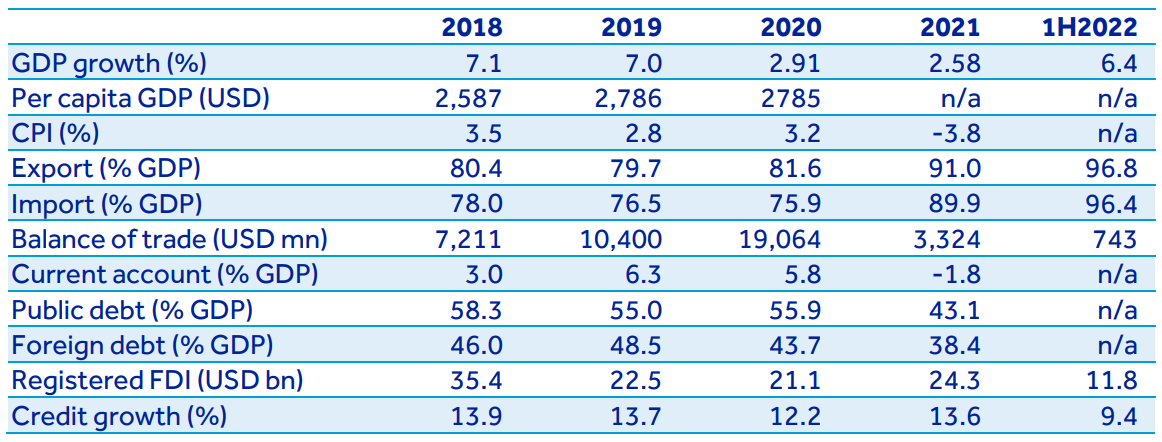

The first half of 2022 saw a strong divergence between Vietnam’s economic performance and the performance of the stock market. Vietnams economy roared back to post first half GDP growth of 6.42%, with most major indicators trending in a positive direction, while the VNIndex was among the poorest performing equity markets globally, posting a -20.3% return in 1H, driven by both domestic and global events shaking investor confidence. The strong rebound in the economy was led by the return of domestic consumption (retail sales +11.7% y/y) and the resumption of manufacturing activities (IIP increased 8.7% y/y) after severe disruptions from COVID-19 restrictions in 2021. Inflationary concerns have taken the forefront of investors’ minds globally, yet Vietnam’s CPI posted a reasonable 2.44% on average YTD in the first half of 2022 and 2.89% as of Sept; we are optimistic that whole year inflation will remain within the government’s target of 4% as we’re seeing sigs that the worst pressures have passed. Vietnam continues to be an attractive destination for FDI with disbursed investment increasing 8.9% y/y in the first half to reach 10b USD.

In contrast with the impressive economic rebound, the VNIndex dropped 20.3% in 1H 2022 as increasing global uncertainties and domestic issues leading to investor trepidation. On the domestic front, a series of anti-corruption measures in 1Q targeting market manipulation and improprieties in bond issuances took their toll on investor confidence; however we believe that in the long run, these moves will be a net positive for the market as rooting out these types of actions should help the long term, sustainable development of the Vietnamese capital markets. On the global front, the outbreak of the war in Ukraine has resulted in an energy crisis as economic sanctions placed on Russia have contributed to an energy shortage and surging prices globally. Disruptions to other key agricultural products (wheat, fertilizers, etc..) have further exacerbated inflationary pressures which have already been strained by supply chain disruptions caused by strict COVID-19 related lockdowns in China as the country continues to pursue a zero-COVID policy. With many developed economies facing stubbornly high single digit inflation figures, central banks have been forced to take aggressive moves to combat surging cost of living increases, which has resulted in a dimmed global economic outlook. As of Sept 27th, the VNIndex has struggled, falling to 1.174 (-22% YTD) as the SBV raised key rates by 100bps in response to continued aggressive hikes by central banks around the world and as the VND has been under devaluation pressure.

Despite the correction to the market so far in 2022, we remain positive about the fundamental outlook for the Vietnamese economy and markets. 1H earnings were strong, posting growth of 18.8% y/y and whole year expectations of 19% appear achievable. As of Sept 27th, the VNIndex trading at a trailing PE of 12.5x and a forward 2022 PE of 11.2, making it one of the cheapest in the ASEAN region.