Update BID – OUTPERFORM

24/07/2024 - 3:24:24 CHBANK FOR FOREIGN TRADE OF VIETNAM (BID)

We recommend OUTPERFORM for BID with a 1-year target price of VND54,000/share based on a target P/B of 2.0 times. Business results in the coming quarters are supported by NIM with plenty of room to recover and asset quality to be stable thanks to solid provision buffers.

BID’s Q1/24 business results have not shown a clear recovery with PBT reaching VND7,390 billion, +6.8% y/y and -6.3% q/q, mainly due to a sharp decrease in NIM. Specifically, NIM in Q1/24 decreased by 30 bps y/y and decreased by 35 bps q/q, reaching only 2.44%, among the lowest in the industry.

However, we see that BID’s NIM has a lot of room to improve thanks to (1) cost of funds can further decrease when high-interest deposit mobilized in the last year matures and (2) lending rates of BID is currently among the lowest in the industry (about 6.86%) and is under little pressure to reduce further. We forecast BID’s full year 2024 NIM to reach 2.8%, an increase of 16 bps.

BID’s credit balance only increased by 0.9% in Q1/24 but recovered quite well in Q2/24 with the credit growth as of June 28 reaching 5.83% ytd, equivalent to the whole sector’s credit growth. We forecast BID’s credit growth for the whole year 2024 to reach 14%.

For Q2/24, we expect BID can record PBT of VND7,800 billion, +12.2% y/y and +5.5% q/q. Cumulatively 6M2024, PBT is expected to complete 49% of our full year forecast.

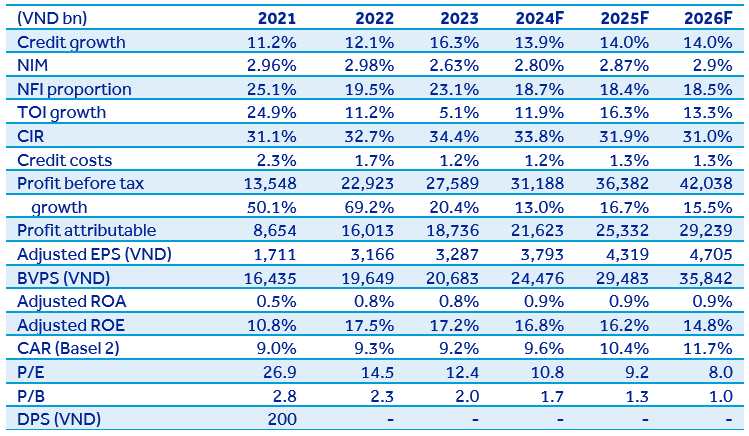

We forecast that PBT in 2024 will reach VND31,188 billion, an increase of 13.0% y/y, driven by theses following assumptions:

(1) Incomes from bancassurance, government bond trading and off-balance sheet debt collection segments are forecast to still face difficulties, while forex income can benefit from exchange rate fluctuations. We forecast that NFI for the whole year 2024 will decrease by 9.5% y/y and account for 18.8% of TOI.

(2) Operating expenses in 2024 are forecast to increase by 10.0% y/y, CIR ratio (not deducting bonus and welfare funds) is expected to decrease to 33.8% from 34.4% as in the last year.

(3) We forecast credit costs in 2024 will be at the same level as last year at 1.2% and provision expenses will increase 12.6% y/y. NPL coverage ratio in 1Q24 decreased from 181% to 153% due to NPL ratio increasing by 26 bps to 1.51%, however this is still a good provision buffer level in the industry.

Estimation of issuance price and impact of private placement deal of 9% of pre-outstanding shares

According to the 2023 AGM Resolution, BID plans to issue a private placement at a ratio of 9% to investors. In 2024, BID plans to privately issue 2.89% of its charter capital. For the remaining 6.11%, BID will search for potential domestic and foreign investors and execute the issuance depending on the market favorability as well as BID’s business prospects.

In 2019, BID privately issued 15% of charter capital to KEB Hana Bank at the issuance price at that time equivalent to a 12-month trailing P/E (pre-money) of 22.2x and P/B after issuance (post money) was 2.0x. We note that at that time, BID was in the process of restructuring legacy NPLs and profits were only low, therefore, P/E valuation multiple of the deal at that time was not reliable and P/B would be a more reasonable measure.

Based on the assumption that the valuation of subsequent issuances is usually not lower than that of previous issuances within 3-5 years, we estimate that the issuance price this time will also fall around P/B of 2.0x, corresponding to a price of VND48,000-59,000/share depending on the time of issuance.

After completing the above private placements, we estimate that BID’s capital adequacy ratio (CAR) will improve by about 1.6 percentage points. Improving CAR for BID plays a more important role than for other banks when BID’s CAR by the end of 2023 is only 9.18%, quite close to the minimum requirement of 8% and lower than the whole industry (at the end of May 2024: 12%). The issuance proceeds will help improve BID’s credit growth capability as well as prepare for more stringent capital standards of Basel 3 in the future.

However, with an increase of more than 20% in equity capital, BID’s ROE will face downward pressure, forecast from the current level of over 17% to 15% after issuance – equivalent to the industry average.