FPT CORPORATION (FPT VN)

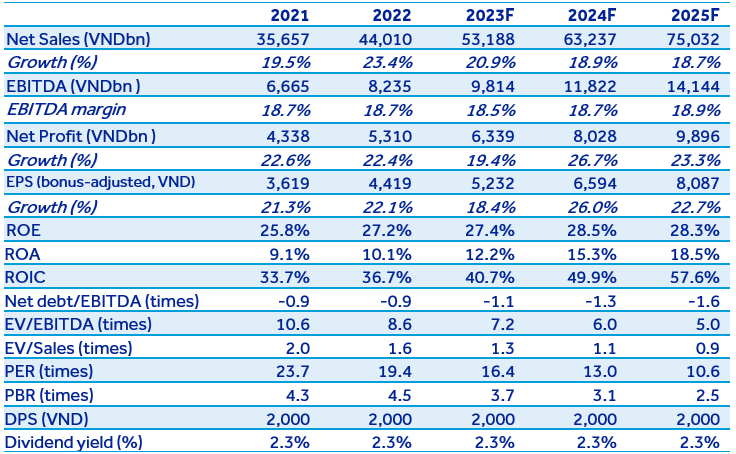

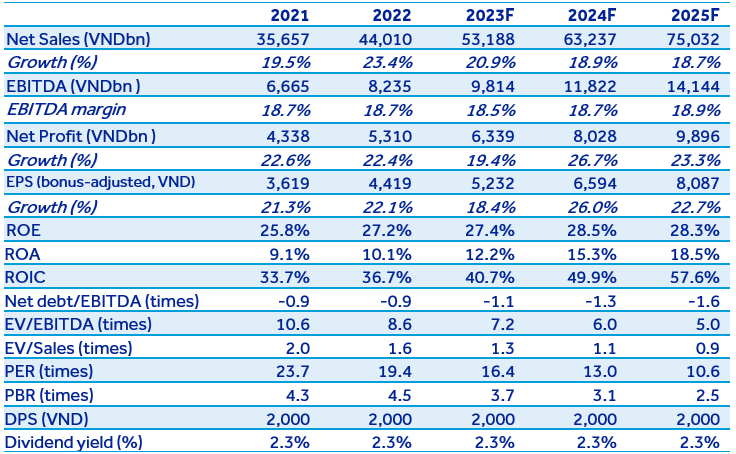

The company retained solid growth in the first five months of 2023, driven by 32% YoY growth in the global IT services segment, and is expected to extend the momentum for the whole year. Maintain BUY recommendation with a target price of VND96,646/share, equivalent to a total return of 15.0% at the end of 2023.

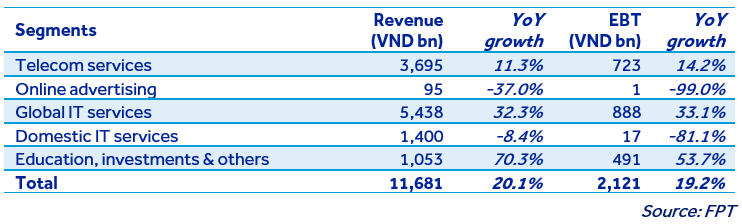

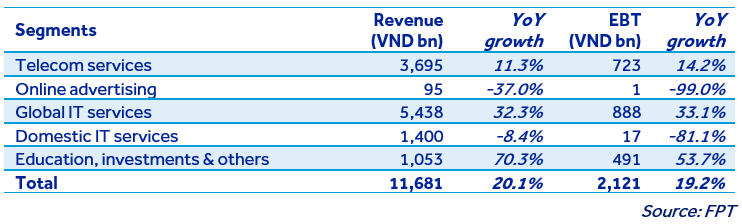

FPT announced net revenue and EBT growth of 20.1% and 19.2% YoY, reaching VND11,681bn and VND2,121bn, respectively, in 1Q23. The growth rates sustained in 5M23 with 22.9% and 19.2% YoY, respectively.

FPT’s 1Q23 business results:

The global IT services segment continued to deliver stellar revenue growth of 32% YoY in 1Q and 5M23, while EBT grew by 29.3% YoY in 5M23. Most of its major markets performed well, including the US (+18% YoY in 1Q; +14% in 5M), APAC (+65.7% in 1Q; +50.4% in 5M), Europe (+10% in 1Q; +14% in 5M). Japan and the US remain the largest earners, capturing 37% and 30% of the segmented revenue respectively, followed by APAC (26%) and Europe (7%). Revenue from Japan has been on recovery, growing by 31.2% in 1Q and 41% YoY in 5M23. This recovery is expected to extend thanks to resurgence of investments on IT services and digital transformation post COVID-19. FPT expects the global IT services segment to achieve $1bn of revenue this year.

With a continued focus on digital transformation (DX) services, DX revenue enlarged its contribution to 42.3% of the segmented revenue, jumping by 28% YoY in 1Q and 38% YoY in 5M23. FPT emphasized technologies such as cloud computing, artificial intelligence (AI)/data analytics, low code, etc.

View details in full report below.