FPT DIGITAL RETAIL JSC (FRT VN)

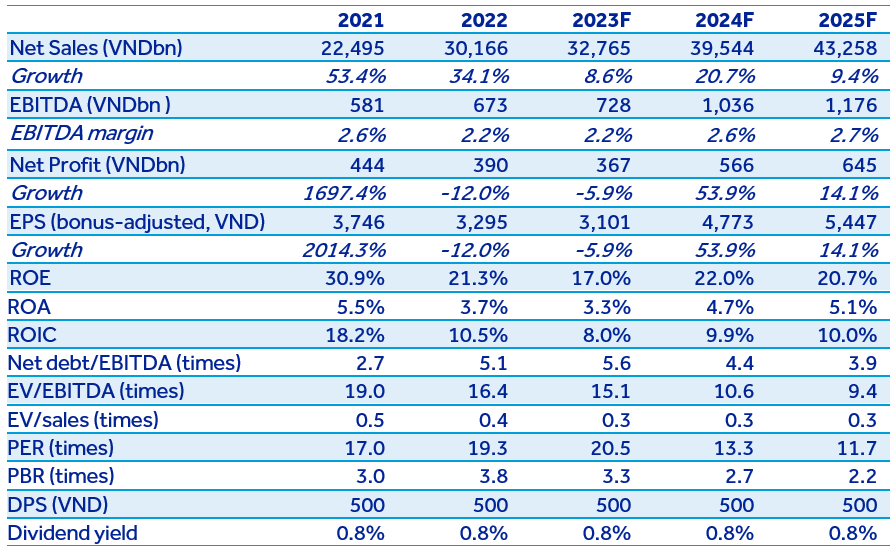

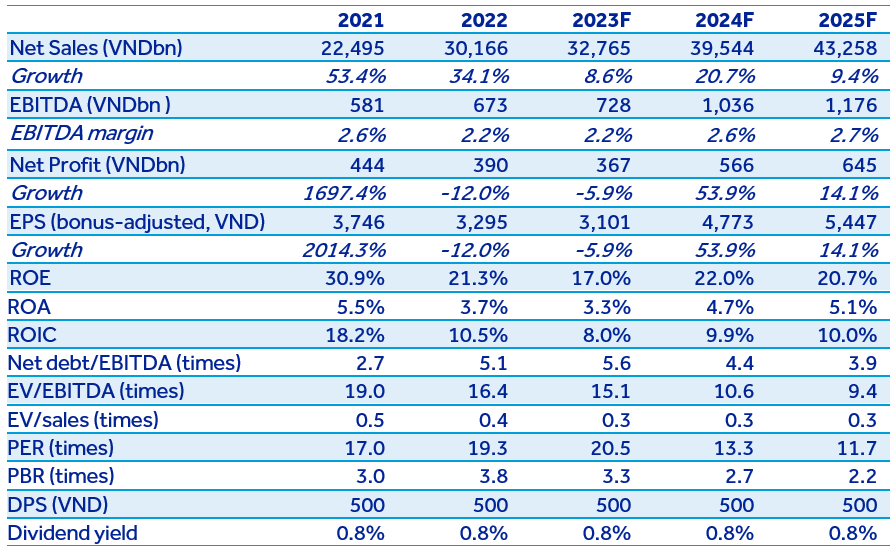

We revise down our projections to intensify caution about the company’s growth in 2023 in light of weak consumer spending power. Downgrade recommendation to NEUTRAL with a target price of VND63,521/share, representing a 0.5% expected total return at the end of 2023.

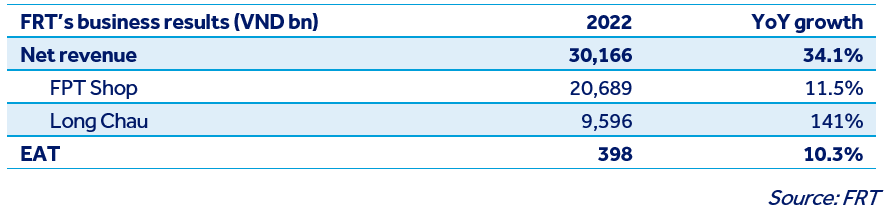

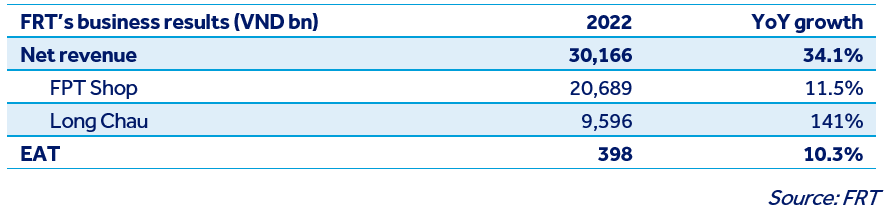

FRT announced net revenue of VND30,166bn (+34.1% YoY) and EAT of VND398bn (+10.3% YoY) in 2022. Divergence in the results was attributed to a higher SG&A expenses to net revenue ratio (13.7% in 2022 vs. 11.8% in 2021, mostly resulting from Long Chau) and financial profit turning from VND52bn in 2021 to negative VND82bn in 2022 (largely stemming from a 75% increase in interest expense), despite a widened gross margin (15.6% in 2022 vs. 14.0% in 2021, thanks to Long Chau’s improved margin).

The FPTShop chain reported VND20,689bn (+11.5% YoY) in revenue, with Apple products accounting for c.50% of the total. The chain experienced a 22.5% YoY drop in revenue in 4Q22, irrespective of 32.3% YoY growth in 9M22. This was due to a high base in the same period in 2021 and weakening consumer spending, which may result from concerns about income uncertainty as well as job security amid the cloudy economic outlook, lay-off in many manufacturers, and higher interest rates discouraging consumer finance activity, etc.

The chain opened 139 new stores, bringing its number of stores in operation to 786 at the end of 2022 (YE2021: 647). FRT is prudent about opening new FPTShop stores in 2023 considering the economic outlook and consumer spending.

Home appliances, which had been added to FPTShop since 2021, were present in 280 stores at the end of 2022 and are expected to expand to 600 stores in 2023. However, their contribution remained humble (accounting for c.2.5% of the chain’s top line in 2022; gross margin of 20-25%). Additionally, according to the company’s proposal approved in the recent annual general meeting, FRT might add bicycles, motorbikes, spare parts, maintenance and repair services to its products/services portfolio to optimize trading space. Some of these products are popular and can encounter competition from other retail chains and may take time to capture a significant portion in the overall results; however, they may help FPTShop increase revenue per store and customer traffic in the midst of the mature market of ICT products.

The Long Chau pharmacy chain continued to report vivid growth of 141% YoY in revenue, to VND9,596bn, in 2022 driven by strong network expansion and less impacts to drug consumption by the economic turmoil. The average revenue per store per quarter was estimated at VND2.7-3.2bn in 2Q, 3Q and 4Q22, after touching VND3.92bn in 1Q owing to surging demand for drugs/healthcare products given the COVID-19 outbreak. At YE2022, Long Chau had 937 shops in operation (YE2021: 400), covering 63 provinces/cities, compared with about 936 Pharmacity stores (63 provinces/cities) and 530 An Khang stores (63 provinces/cities). While Long Chau started to make profit from 2021, the others have not.

Long Chau earned c.VND53bn of EBT in 2022 (2021: VND4.9bn), although the bulk of earnings (VND31bn) were recorded in 1Q in conjunction with the revenue surge driven by surging demand for drugs/healthcare products in view of COVID-19 outbreak. The chain’s gross margin achieved 23.6% in 2022, compared to 20.9% in 2021. Although this margin still has potential to broaden further, we do not assume a sharp pattern for the improvement considering the company’s target of an affordable/low selling price strategy to expand the customer base.

View details in full report below.