MWG update – BUY

30/09/2022 - 4:52:45 CHForecast and valuation

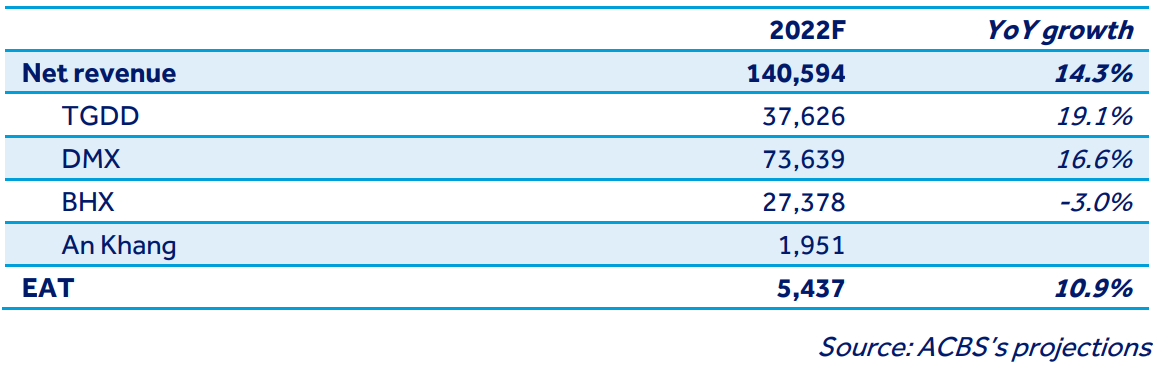

ACBS project MWG may complete 100% of its full-year revenue plan but 86% of EAT plan in 2022. 2022 net revenue and EAT were projected at VND140,594bn (+14.3% YoY) and VND5,437bn (+10.9 YoY). For 2023, driven by expectations about BHX’s enhanced profitability, the EAT growth is projected at 30% YoY while expected revenue growth is 13% YoY.

Among pilot businesses introduced early this year, AVA Kids and AVA Sports witnessed their number stores increasing to 80 and 12, respectively, at the end of August 2022, given their encouraging results, while other businesses (i.e AVA Fashion and AVA Ji) stopped. Our projections have not incorporated these new businesses until there are more details.

We use DCF and EV/Sales comparison methods to evaluate the stock; in which, the EV/Sales method was used in light of the company focusing on improving BHX’s revenue and An Khang starting to contribute revenue though net profit is not expected. Target price for the stock is VND76k/share, equivalent to a total return of 21.4% at YE2023.

View details in full report below.