IMP Flash note – OUTPERFORM

22/04/2025 - 1:31:49 CHIMEXPHARM CORPORATION (IMP VN)

The company maintained a solid growth momentum with a 20.4% YoY upturn in EAT in 1Q2025. We maintain our target price for the stock by YE2025 at VND48,300/share, equivalent to a total return of 12.2%. Rating OUTPERFORM.

IMP announced net revenue at VND594bn (+21% YoY) and EAT at VND75bn (+20.4% YoY) in 1Q2025, meeting 24% and 20% of our full-year projections, respectively. Sales of finished goods captured almost 100% of its net revenue.

The net revenue growth was driven by strong growth in both the hospital and pharmacy channels (+27% and 25% YoY in terms of gross revenue, respectively). The performance was underpinned primarily by high drug demand (e.g. cough medicines, contributing 11% to total revenue, delivered a 42% YoY growth) during the spread of respiratory diseases in the first months of the year. Furthermore, the hospital channel sustained its growth stream while the pharmacy channel witnessed improvements, especially in the northern market (+69% YoY; contributing 12% of the channel revenue) where IMP aims to expand this year.

The EAT growth was bolstered by a widened gross margin, to 39.5% in 1Q2025 (1Q2024: 36.8%) thanks to heightened efficiency stemming from ramping up production across its EU-GMP certified factories, especially IMP4 factory – which came online from 3Q2023 – recording a 126% YoY output increase. This was despite a jump in the SG&A expenses to net revenue ratio to 22.7% (1Q2024: 19.8%), explained by more brand marketing activities and promotion campaigns across both channels.

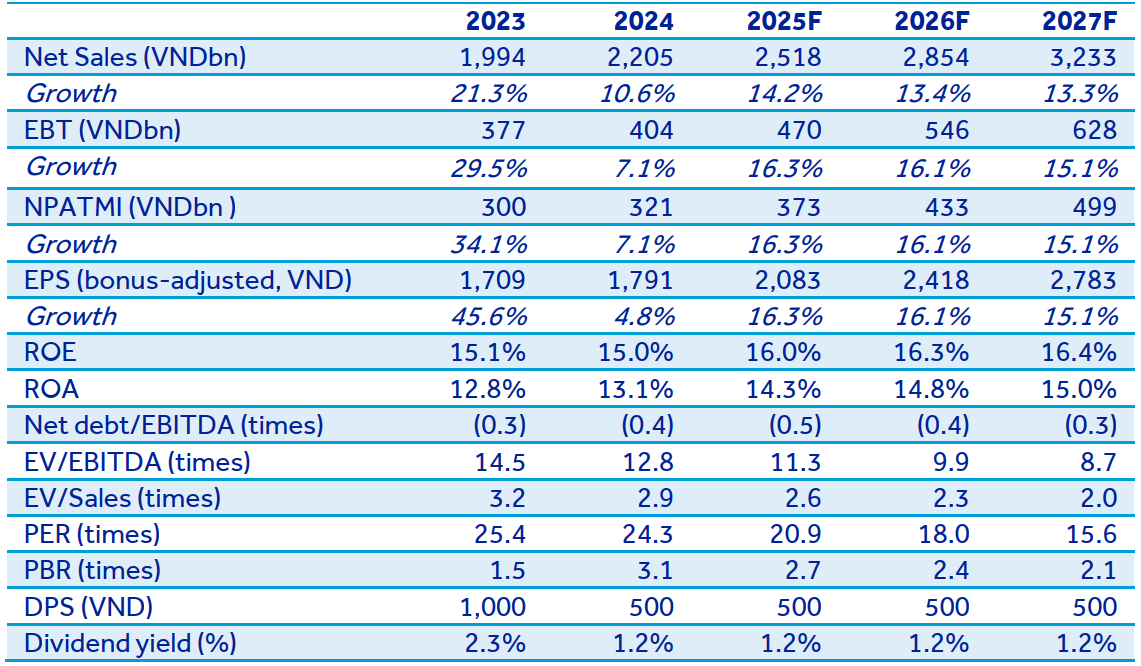

Outlook: We retain our projections that the company may deliver VND2,518bn of net revenue (+14.2% YoY) and EAT of VND373bn (+16.3% YoY) in 2025, fueled by the company’s continued investments in high-value products, advanced production standards, and higher contribution from IMP4. IMP and many Vietnamese pharmaceutical companies are likely find little direct impact from the US’s higher tariff given a modest share (of 1-2%) from exports in their revenue and the absence of the US in their customer lists.