DPM Flash note – BUY

01/11/2023 - 10:01:58 SAPetroVietnam Fertilizer and Chemicals Corp (DPM VN)

DPM recorded a sharp decline in the Q3/2023, with revenue reaching VND3,215 billion (-17.2% YoY) and NPAT-MI of VND64 billion (-93.5% YoY, -36.5% q/q), lower than our expectations. Accumulated in 9M2023, NPAT-MI decreased by 90.4% YoY, completing 18.8% of DPM’s annual plan and 39% of our previous forecast.

Compared to Q2/2023, the decrease of NPAT-MI in Q3 came from a sharp decline of 85.3% q/q in financial revenue to VND27.2 billion, of which, primarily attributed to a decrease in interest income from deposits and loans, while cash balance + deposits only decreased 11% q/q. As this can be related to the booking timing of bank deposits interest income. Therefore, a big increase in interest income is expected in Q4.

Meanwhile, we have witnessed a recovery in core business operations with a gross profit margin increasing to 12.7% from the previous margin of 10.5% in Q2/2023. Despite a 25% q/q decrease in urea selling volume, this decline is seasonal as it reflects low domestic fertilizer demand during this period. The average urea selling price in Q3 saw a healthy increase of 7% q/q as China’s requirement for some fertilizer companies to temporarily halt urea exports to ensure a stable domestic supply. Additionally, the imported fertilizer business segment has improved, recording a positive gross profit of VND36 billion, compared to a gross loss of VND48 billion in Q2/2023.

Compared to last year, Q3/2023 revenue and net profit decreased by 17.2% and 93.5% YoY, respectively. Despite a 12% increase in urea selling volume, the main reason for the decline in revenue and net profit is the 35% decrease in urea selling price and a 59% decrease in NH3 selling price. These reductions are compared to the historical peak levels in 2022. Moreover, despite a 14% YoY decrease in oil prices, the cost of gas inputs has not decreased. This is because DPM has increased the proportion of gas usage from high-priced gas fields as the reserves of low-priced gas fields are decreasing. As a result, the gross profit margin in Q3/2023 has decreased to 12.7% from 38% in Q3/2022.

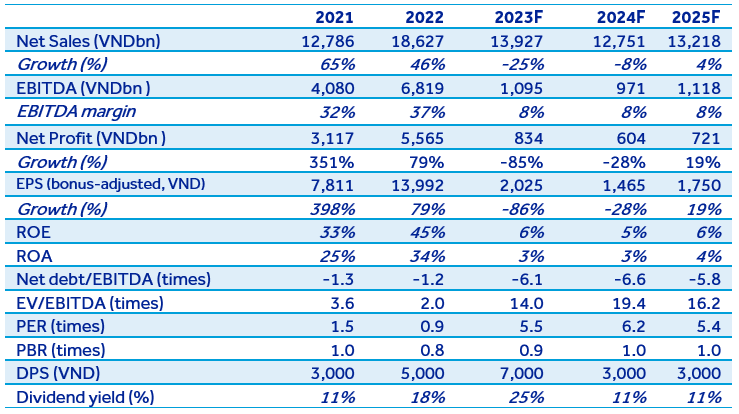

Quick comment: DPM’s revenue for 9M2023 reached VND10,187 billion (-30.8% YoY), and NPAT-MI at VND424.9 billion (-90.4% YoY), achieving 73% and 51% of our full-year projections, respectively. We have adjusted our forecasts for DPM’s business results in 2023 and 2024 down by 24% and 25% respectively compared to the latest projections. Looking ahead to 2024, we forecast DPM to achieve revenue of VND12,751 billion (-8.4% YoY) and NPAT-MI of VND604 billion (-27.6% YoY). Our target price for DPM by the end of 2024 is VND34,200/ share, equivalent to a total return of 31.2%. Further details will be provided in the next update report.