FPT Flash note – BUY

23/10/2023 - 1:40:01 CHFPT CORPORATION (FPT VN)

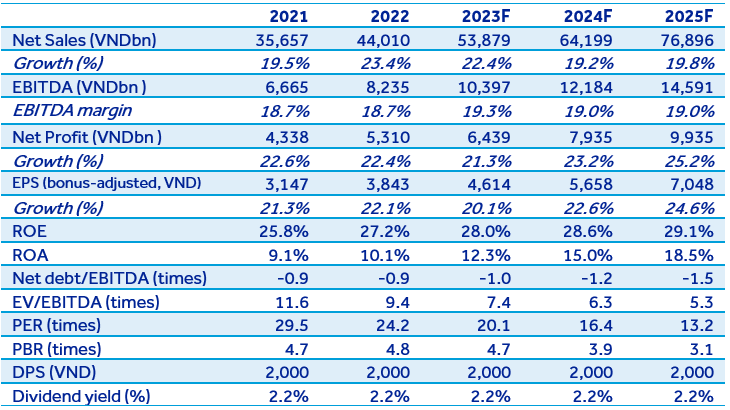

The company maintained strong performance in 9M2023, driven by a solid growth momentum in the global IT services segment, which was quite in line with our expectations. Reiterate our BUY rating and move target price to 2024 at VND114,155/share.

FPT announced 9M2023 revenue of VND37,927bn (+22.4% y/y) and EBT of VND6,768bn (+19.5% y/y), completing 70% and 74% of our full-year projections, respectively.

The global IT services segment (Revenue/EBT growth: +30.8%/+29.9% y/y) remained the company’s key driver in 9M2023. This was thanks to growth in all of its major markets, including Japan (+44.1% y/y), APAC (+37.6%), the US (+14.2%), and Europe (+18.6%), fuelled by investments in IT services and digital transformation, especially Japan post COVID-19. Revenue from digital transformation (DX) services jumped by 46% y/y, capturing 43.7% of the segmented revenue in 9M2023.

The domestic IT services segment (+9.9%/-32.0% y/y) improved in terms of revenue growth compared to that in 1H2023 though EBT did not move in the same direction. The segment’s weak performance was attributed to a curb or delay in enterprises’ IT spending amid the tough economy.

The telecom services segment (+10.1%/+15.0% y/y) maintained stable revenue and EBT growth in 9M2023, while the online advertising segment (-26.8%/-65.9%) still reported lacklustre results due to a reduction in companies’ advertising budget in light of the tough economy. The education segment continued to post splendid revenue growth of 43% y/y.

Financial profit increased by 38% y/y, to VND625bn (mostly thanks to interest income and dividend), contributing to the company’s EBT growth. Meanwhile, profit from affiliates tumbled by 95% y/y, which might result from FRT’s poor performance.

Quick comment: Ending 9M2023, FPT completed 75% of the company’s EBT target and 74% of our projections. Looking to 2024, our projections for FPT’s net revenue and EBT are VND64,199bn (+19.2% y/y) and VND11,048bn (+21.1% y/y). Our target price for FPT by the end of 2024 is VND114,155/share, equivalent to a total return of 25%. Further details will be given in the next update report.