NT2 Flash note – OUTPERFORM

19/10/2023 - 4:58:59 CHNhon Trach 2 Thermal Power JSC (HOSE: NT2)

NT2 disclosed its business results for Q3/2023, which were quite significantly below our expectation. Specifically, NPAT incurred a loss of 124 bn dong, (Q3/2022: +199 bn dong). Accumulated 9M2023, NPAT reached 256 bn dong, completing 54% of their 2023’s plan.

Q3/2023 revenue reached 816 bn dong, -62.4% yoy, leading to -132 VNDbn of gross profit. The underlying reason is the maintenance plan to comply with 100,000 EOH from Sep-07.

After every 25,000 hours of operation, NT2 is required to cease operations from approximately 15-30 days for maintenance. The most recent maintenance was performed in the Q3/2020, which led to a loss of 5 bn dong of NPAT. Nevertheless, this year’s loss is significantly greater than what we forecasted, potentially due to an extended maintenance period and the failure of the COGS component to reflect a corresponding reduction in expenses beyond basic material costs. As a consequence, the gross profit experienced a decline of 133 VNDbn meanwhile the gross profit in Q3/2022 was 423 bn dong. The cumulative gross profit margin for 9M2023 was a mere 5.4%, in stark contrast to the 14.7% yoy.

The financial income for Q3/2023 increased marginally to 24.67 billion VND. Accumulated 9M2023, financial income reached 52.17 bn dong, compared to a loss of 1.87 bn dong yoy. The primary factor stems from the substantial increase in interest rates on bank deposits.

In 9M2023, management expenses decreased abruptly by 78%, to 54.26 bn dong. The underlying reason is the partial reversal of the provision for bad debts from EVN, which amounted to 239.61 bn dong at the conclusion of 2022, into 2023.

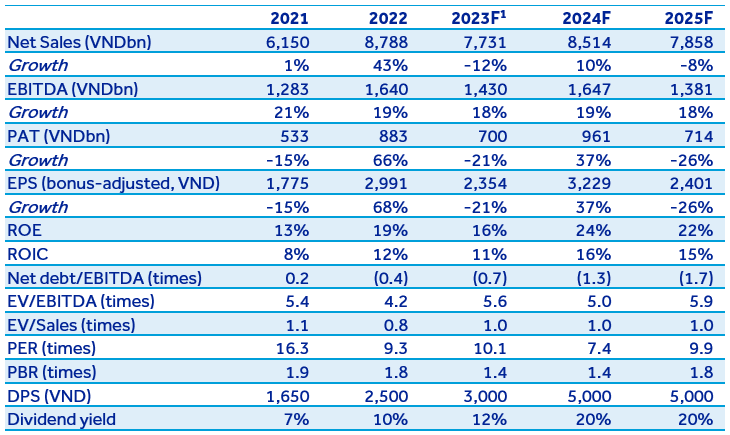

Brief comment: NT2’s Q3/2023 results were comparatively unsatisfactory, attaining a mere 54% of the company’s NPAT target and 36.5% of our prior forecast. We are currently examining the elements that contributed to the significant loss that exceeded both our expectation and the similar situation in 2020, despite the fact that this maintenance was factored into the plan and model valuation. Forecasts and valuations for 2023 and 2024 shall be revised in our subsequent report.