PVS Update – Neutral

25/12/2023 - 11:56:59 SAPetroVietnam Technical Services Corporation (HNX: PVS)

PVS announced business results for Q3/2023, with a NPAT-MI of VND141 billion (-26.5% YoY and -37% QoQ), lower than our expectations. However, the accumulated 9M2023 NPAT-MI increased by 39.6% YoY, reaching VND579 billion (+37.8% YoY), fulfilling 108% PVS’s annual plan and 66% of our full-year forecast.

PVS recorded a Q3/2023 revenue of VND4,175 billion (+26.5% YoY) and a NPAT-MI of VND141 billion (-26.5% YoY and -37% QoQ). The primary driver of the revenue increase was a 26% YoY growth in revenue from the Mechanical and Construction segment (M&C) and a 152% YoY growth in the Operations and Maintenance segment (O&M). However, the decrease in profit was due to several factors:

(1) Gross profit margin for the FPSO segment dropped to 0% in Q3/2023 and 3.9% in 9M2023.

(2) Gross profit margin for the Offshore support vessels (OSV) segment decreased to 9.9% from 12% in the same period last year.

(3) G&A expenses increased by 54.7% YoY to VND262 billion.

(4) Additionally, in Q3/2023, the Other Profit category recorded a loss of VND21 billion due to the contract termination of the FPSO Lam Son (6/2017), compared to a profit of VND8.1 billion in the same period last year.

(5) Financial expense increased by 138% YoY to VND46.7 billion.

These factors overshadowed the positive impact of a 55.8% YoY increase in financial revenue to VND211 billion. Cumulatively for 9M2023, PVS achieved a revenue of VND12,591 billion (+13.6% YoY) and a NPAT-MI of VND579 billion (+37.8% YoY), completing 73% and 66% of our adjusted full-year forecast, respectively.

Regarding the Block B O Mon project, PVS has been granted 2 contracts: EPCI#1 and EPCI#2 via Limited letter of Agreement (LLOA), although the project has not yet received the Final Investment Decision (FID). Construction for these contracts is expected to commence in 2024.

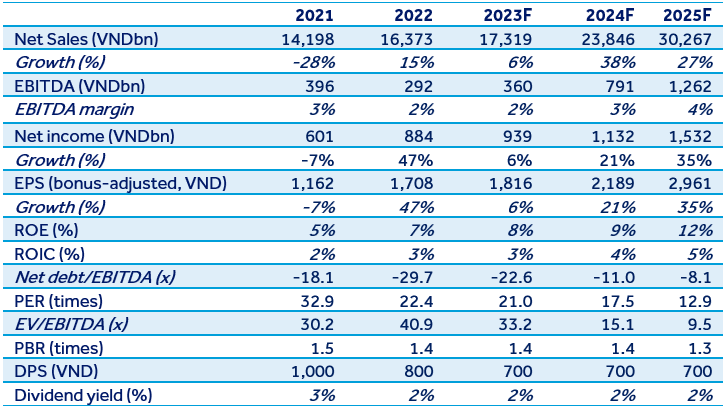

Quick comment: Looking towards 2024, with significant potential from oil and wind power projects, we forecast PVS to achieve revenue of VND23,846 billion (+38% YoY) and NPAT-MI of VND1,132 billion (+21% YoY). Despite the positive business outlook, the stock price has risen by 85% since the beginning of the year, reflecting most of the profit prospects for 2024. Using the DCF method, we value PVS at the end of 2024 at 40,500 VND/share, equivalent to a total return rate of 7.8%. Rating Neutral