FLASH NEWS 24/05/2023 – The State Bank of Vietnam (SBV) announced the adjustment of several key interest rates effective from May 25, 2023

24/05/2023 - 9:52:28 SAThe SBV has issued series of Decisions dated 23/05/2023 on adjusting some key interest rates applicable from May 25, 2023. Accordingly:

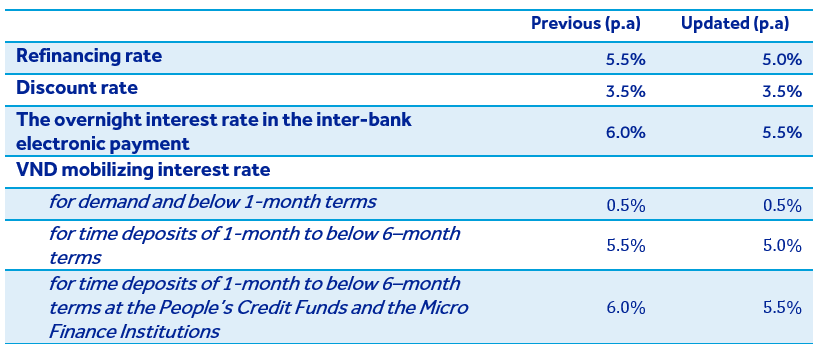

- SBV issued Decision No.950/QĐ-NHNN dated 23/05/2023 in which refinancing rate will decline from 5.5% p.a to 5.0% p.a; the overnight interest rate in the inter-bank electronic payment and the rate of loans to finance short balances in clearing transactions between SBV and commercial banks will also decline from 6.0% p.a to 5.5% p.a; the discount rate will remain at 3.5% p.a;

- SBV issued Decision No.951/QĐ-NHNN dated 23/05/2023 stipulating the caps for VND mobilizing interest rates applied for entities and individuals’ deposits at the credit institutions as stipulated in Circular No. 07/2014/TT-NHNN dated March 17, 2014. Accordingly, the maximum VND mobilizing interest rate for demand and below 1-month terms will remain at 0.5% p.a; the maximum VND mobilizing interest rate for time deposits of 1-month to below 6–month terms decreases from 5.5% p.a to 5.0% p.a; the maximum VND mobilizing interest rate for time deposits of 1-month to below 6–month terms at the People’s Credit Funds and the Micro Finance Institutions is lowered from 6.0% p.a to 5.5% p.a; the mobilizing interest rates for 6-month plus terms may be decided by the credit institution based on the capital supply and demand in the market.

Interest rates summary:

View details in full report below.