PVS’s 3Q2022 business results

31/10/2022 - 11:22:34 SAAfter recording a sharp decline in Q2, PVS announced 3Q2022 consolidated business results with a smaller decrease in revenue to VND3,503 billion (-12% YoY) and EAT of parent company’s shareholders VND192 billion (-13% YoY). Despite continuing to record foreign exchange gain at VND69 billion for Q3 (much higher than VND4.2 billion in the same period last year), PVS’s NPAT still decreased due to: (1) loss in M&C and O&M segments (2) lower reversal of guaranteed provision for some M&C projects, and (3) decrease in profits from joint ventures.

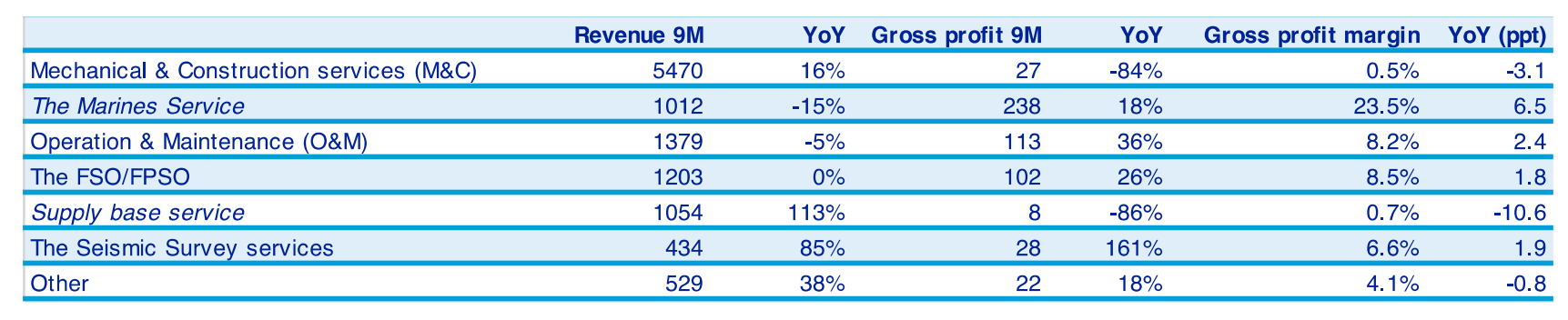

With this result, PVS recorded 9M2022 with revenue of VND11,087 billion (+14.6% YoY) and NPAT of VND 415 billion (-19.7% YoY). Overall, the decrease in NPAT came from:

• Gross profit margin decreased from 6.4% to 4.9% YoY. In which, gross profit margin of O&M segment fell from 11.3% to 0.7%. Besides that, contribution margin of M&C segment (the main contributor to PVS’s revenue) also decreased to 0.5% from 3.6% due to a higher proportion of international contracts (Gallaf phase 2 & 3; Hai Long, Shwe) which tend to give lower profit margin.

• Lower reversal of guaranteed provision for M&C projects

• General and administrative expenses increased 9.1% YoY, in which specifically labor and transportation costs

PVS sets a target for the whole year of 2022 with revenue of VND10,000 billion and NPAT of VND488 billion, down 29.6% and 28% respectively compared to 2021 reported results.