FRT Update – NEUTRAL

22/11/2023 - 9:48:22 SAFPT DIGITAL RETAIL JSC (FRT VN)

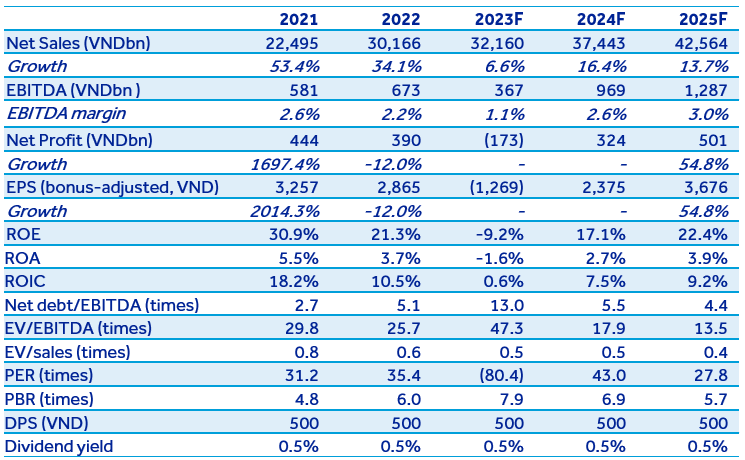

The company witnessed a considerable shrink in its loss after tax in 3Q2023 against 2Q2023, thanks to improved profit margins of the FPTShop chain, outperforming our projections. We expect the company may return to profit in 2024, fueled by the same movement in the FPTShop chain and Long Chau’s continued growth. Rating NEUTRAL and moving target price to 2024 at VND109,045/share.

FRT announced net revenue of VND8,236bn (+6.8% y/y) and loss after tax (LAT) of VND13bn in 3Q2023, weighed by the FPTShop chain’s sluggish performance. However, the loss reduced significantly compared with that in 2Q2023 (-VND213bn). On a cumulative basis, FRT announced net revenue at VND23,160bn (+6.7% y/y) and LAT at VND226bn in 9M2023.

The FPTShop chain, contributing c.53% of FRT’s sales in 9M2023, reported a slump of 19.8% y/y in revenue and LAT of VND387bn in 9M2023 due to weak consumer spending for ICT products & durable goods and price war among retailers.

The Long Chau pharmacy chain, whose contribution has enlarged rapidly to nearly half of FRT’s sales, continued to deliver vivid growth of 68.9% y/y in revenue and 374% y/y in EAT in 9M2023, fostered by strong network expansion.

The company’s gross margin climbed slightly to 15.7% in 9M2023 (9M2022: 15.5%) while the SG&A expenses to net revenue ratio soared to 15.8% in 9M2023 (9M2022: 13.7%). Financial loss increased to VND181bn from VND39bn in 9M2022, contributing to the loss.

Inventories rose by 12.4% and 20% compared to the end of 2022 and 1H2023, respectively, to VND7,290bn; of which, FPTShop captured 54%. The net debt to equity ratio remained high, increasing from 172% at YE2022 to 294% at the end of September 2023.

Looking to 2024, we project the company may return to profit with EAT of VND351bn on net revenue of VND37,443bn (+16.4% y/y). Our target price for FRT by the end of 2024 is VND109,045/share, equivalent to a total return of 7.4%.