MWG Update – BUY

11/12/2023 - 10:42:55 SAMOBILE WORLD INVESTMENT CORP (MWG VN)

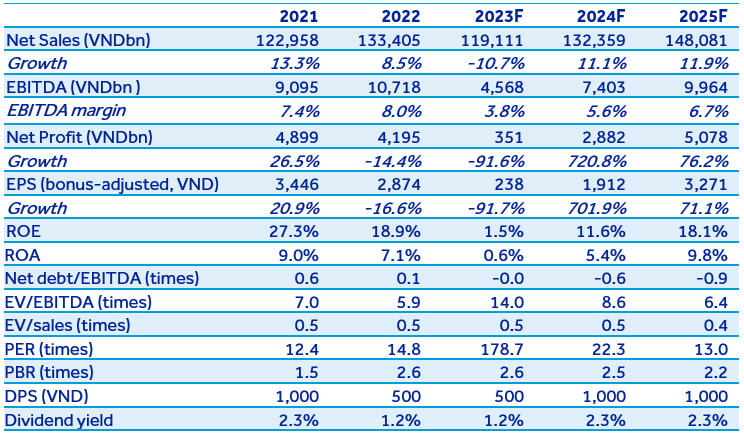

We revised down our projections for 2023-2024 to reflect the expectation of slower improvement in profit margins, given the company’s focus on boosting revenue rather than profit margins, and the plan to close 200 stores in 4Q2023. Revise target price to VND51,170/share. Maintain BUY.

MWG announced net revenue of VND86,858bn (-15.5% y/y) and EAT of VND78bn (-97.8% y/y) in 9M2023, weighed by TGDD & DMX’s dim performance. However, the decline in cumulative revenue slowed down in 3Q2023. October recorded the first positive growth rate (+2.7% y/y) of the year.

The TGDD & DMX chains, together capturing 71.8% of MWG’s sales, slumped by 23.3% y/y in revenue in 9M2023 and 21.7% y/y in 10M2023 due to weak consumer spending for ICT products – durable goods and price war among retailers.

BHX, making up 25.7% of MWG’s sales, generated revenue growth of 11.8% y/y in 9M2023 and 13.9% y/y in 10M2023 thanks to increasing revenue per store. There is no new update about its private placement process.

An Khang which contributes very modest to MWG’s sales (2%-3% in 2023-2024) continued to focus on fostering revenue per store and optimizing operations to enhance business efficiency, whereas expansion of the store network is not a priority.

The company’s gross margin shrank to 18.8% in 9M2023 (9M2022: 22.2%) while the SG&A expenses to net revenue ratio soared to 18.7% in 9M2023 (9M2022: 16.8%). Financial profit jumped to VND426bn in 9M2023 from VND0.3bn in 9M2022, contributing to the EAT.

Inventories at the end of Sept 2023 climbed by just 3% compared to the end of June 2023 but contracted by 11% compared to YE2022. The net debt to equity ratio turned from 6% at YE2022 to -1.5% at the end of Sept 2023 (i.e from net debt to net cash).

In sum, our projections for MWG’s net revenue and EAT are VND132,359bn (+11.1% y/y) and VND2,884bn (+720.8% y/y) in 2024, 33% lower than our previous earnings forecast. Our target price for MWG by the end of 2024 is VND51,170/share, 10% lower than the previous update, equivalent to a total return of 22.5%.