DCM Flash note – OUTPERFORM

26/10/2023 - 5:36:31 CHPetro Viet Nam Ca Mau Fertilizer JSC (DCM VN)

DCM announced a sharp decline in Q3/2023 earnings results with NPATMI only reaching VND73.7 billion (-90% YoY and -74.4% QoQ), much lower than our expectations. Accumulated 9M2023, NPAT-MI decreased by 81% YoY, completing only 44% of the DCM’s annual plan and 54% of our full year forecast.

DCM recorded Q3/2023 revenue at VND3,151 billion (-8.9% YoY) and NPATMI of VND73.7 billion (-90% YoY). With urea selling volume increasing by 21% YoY to 230 thousand tons in Q3/2023, the decrease in revenue and net profit is mainly due to a 35% YoY decrease in urea selling price. Tight global fertilizer supply improving along with sharp decline in Europe gas prices have caused urea selling prices to drop significantly compared to the historic peak in 2022. Meanwhile, gas input costs for DCM have not decreased, even though oil prices decreased by 14% due to DCM applying a new gas pricing formula. As a result, gross profit margin in Q3/2023 decreased to 5.9%, lower than the gross profit margin of 30% in the same period last year.

In addition, notably when compared with Q2/2023 business results, Q3/2023 revenue and NPATMI also decreased sharply by 8.5% and 74.4% QoQ, respectively. Explanation of this results:

- In Q3/2023, due to seasonality of low demand in local market, DCM increased its fertilizer exports, with export urea volume increasing by 93.5% q/q, to compensate for low domestic urea demand. However, the export price of urea decreased by 8.7% QoQ while the cost of input gas prices increased by 5% QoQ.

- NPK selling volume decreased by 43% QoQ.

- Selling expenses increased by 29.7% QoQ as DCM promoted sales activities, expanded markets and exported goods.

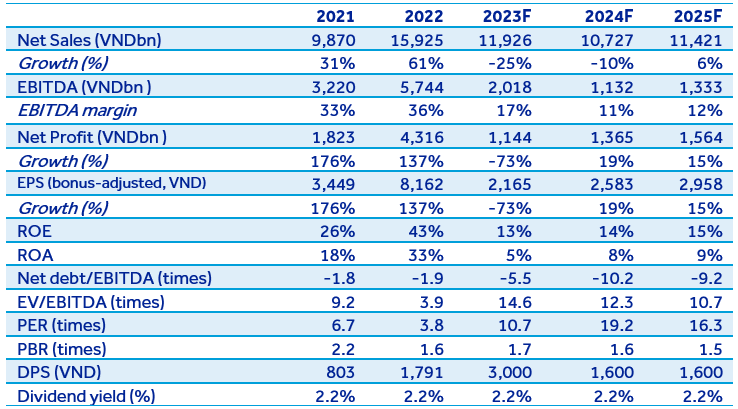

Quick comment: With this results, DCM’s revenue in 9M2023 reached VND9,436 billion (-20.6% YoY) and NPATMI of VND613.8 billion (-81.2% YoY), completed 79% and 54% of our projection respectively. We adjust our forecast for business results in 2023 and 2024 down compared to the most recent forecast by 7% and 10.6%. Looking forward to 2024, our projections for DCM’s revenue and NPATMI are VND10,726 billion (-10% YoY) and VND1,365 billion (+19.3 YoY). Our target price for DCM by the end of 2024 is 34,900 VND/share, equivalent to a total return of 15.1%. Further details will be given in the next update report.