NLG Flash note – BUY

23/10/2023 - 2:26:34 CHNAM LONG INVESTMENT CORPORATION (NLG VN)

Revenue and PBT in 3Q2023 decreased significantly YoY but net profit jumped by more than 8 times YoY, to VND66 bn thanks to deferred corporate income tax of VND81 bn. Net profit in 9M2023 reached VND194 bn, completing 1/3 of the whole year target.

Revenue in 3Q2023 was VND357 bn (-59.5% YoY) mainly due to lower number of units handed over at Southgate, Akari and Novia projects compared to the same period last year. Revenue in 9M2023 was VND1,545 bn (-43% YoY) mainly due to lower number of units handed over in the above projects (323 units vs 813 units), of which the Southgate project accounted for the largest proportion with 296 units and revenue of VND1,281 bn.

Financial expenses in 3Q2023 and 9M2023 increased sharply to VND66 bn (+38.3% YoY) and VND217 bn (+68.4% YoY), respectively due to an increase of over VND1,000 bn in total debts from 3Q2022 to 3Q2023.

Profit from associates and joint ventures reached VND89 bn in 3Q2023 thanks to the delivery of Mizuki project while this amount was not recorded in the same period last year. In 9M2023, this amount reached VND205 bn, much higher than VND3 bn in 9M2022 thanks to the delivery of 890 units at the Mizuki project.

Sales results in 3Q2023 decreased compared to the same period last year but improved compared to the previous quarter. The company sold 235 units at Mizuki, Akari and Southgate projects (-48% YoY, +40% QoQ) with a total value of over VND900 bn (-40% YoY, +43% QoQ). In 9M2023, 448 units were sold (-77.5% YoY) with a total value of nearly VND1,800 bn (-82.2% YoY).

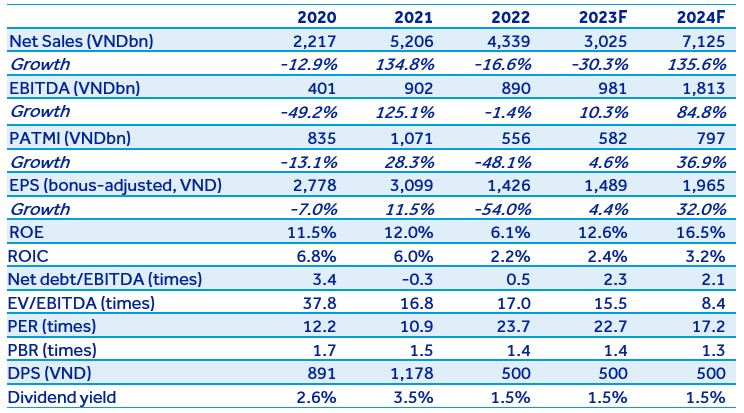

Quick comment: Net profit in 9M2023 was equivalent to 1/3 of our 2023 forecast. We revise estimated 2023 net profit from VND683bn to VND582bn and expect that the company will speed up project deliveries and record the transfer of 25% of Paragon Dai Phuoc in 4Q2023. For 2024, we forecast revenue at VND7,125 bn (+135.6% YoY) and net profit at VND797 bn (+36.9% YoY). We roll forward the valuation to 2024 with a target price of VND40,432/share. Details of forecast and valuation will be updated in the upcoming report.