SIP Update – BUY

05/12/2023 - 1:55:14 CHSAIGON VRG INVESTMENT CORPORATION (SIP VN)

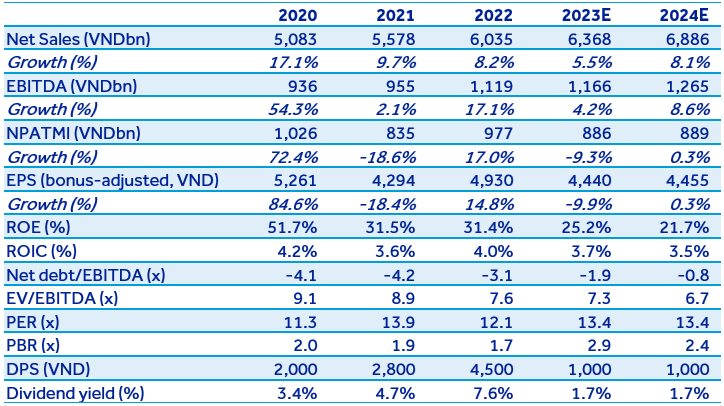

Flat 9M2023 results with revenue in line with our forecast while profit below expectation. Adjust 2023 NPAT down by 16% and reiterate our Buy rating with 2024 target price of VND77,926 (+31% upside).

9M2023 business results went sideway

SIP recorded a flat 9M2023 result with net revenue of nearly VND4.8trn (+3.6% YoY) and NPAT of VND663bn (-5.2% YoY), equivalent to 75% and 59% of our forecast. The slight increase in the top line was mainly thanks to a 4.6% YoY growth in revenue of power and water supply. The slight decline in the bottom line was mainly due to:

- A 30 bps YoY decrease in gross margin from 13.7% to 13.4% which was primarily driven by a lower gross margin of land leasing in industrial parks (IPs) (57.5% vs 71.0%) when the company adjusted the total investment of Loc An Binh Son IP.

- Higher financial expenses (VND71bn vs VND21bn) due to higher interest expenses from higher debt balance and higher provision for investments in Casumina (HSX: CSM) and Vietnam Rubber Group (HSX: GVR).

Net cash/Equity of 60.7%, still in the Top 3 highest in the industry

In 9M2023, SIP’s total debts increased by nearly VND600bn, to nearly VND1.3trn while cash & cash equivalent dropped by nearly VND600bn, to over VND3.6trn, equivalent to 18% of total assets. Net cash/Equity ratio declined from 96.2% to 60.7% during this period but still much higher than the industry median of 12%.

Stop lending to An Loc company and start lending to VCBS

During 2Q2023, SIP’s VND1.8trn loan to its biggest shareholder – An Loc Urban Development & Investment JSC – reduced to zero. In 3Q2023, to utilize free cash, the company lent over VND700bn to Vietcombank Securities (VCBS) with an interest rate of 6-7.3%/year and no collateral. Thus, deposit and lending interest income decreased by 17.6% YoY, to VND187bn in 9M2023. On the other hand, Vietinbank Securities (HSX: CTS) plans to borrow maximum of VND2trn from SIP.

Forecast and valuation

We keep our estimated 2023 revenue virtually unchanged at VND6.4trn (+5.5% YoY) but revise estimated 2023 PAT down by 16% to VND948bn (-6.1% YoY) given lower gross margin of the IP segment and higher financial expenses than expected. For 2024, we project revenue at nearly VND6.9trn (+8.1% YoY) and PAT at VND951bn (+0.3% YoY) given more tenants operating at Phuoc Dong IP, more rooftop solar panels installed but lower financial income and higher financial expenses. Using the NAV method, we derive a target price of VND77,926/share at YE2024 and reiterate our BUY rating. Our main concern for this stock is low liquidity although it shifted from UpCOM to HOSE.