Update TCB – BUY

04/08/2023 - 3:35:13 CHVIETNAM TECHNOLOGICAL AND COMMERCIAL JOINT STOCK BANK (TCB)

6M2023 business results decreased y/y

Profit before tax in 6M2023 dropped by 20.1% y/y mainly due to a sharp decrease in NIM. Cost of funds continued to increase in Q2/23, although at a slower rate, due to high deposit rates in the Q4/22-Q1/23 period. Meanwhile, TCB lowered lending rates in Q2/23, causing NIM to decrease. The bright spot came from the nearly 3 percentage point increase in CASA ratio in Q2/23.

NPL ratio increased by 22 bps q/q, but is still well controlled at 1.07%. The increase in NPLs came from individual and SME lending. Large enterprise lending still maintain a perfect NPL ratio of 0%. Category 2 loan ratio remained at a high level around 2% but management expects it will start decreasing in Q3/23. Restructured loans according to Circular 02/2023 only accounted for a negligible proportion.

NPLs increased while TCB only made moderate provisions, causing LLCR to drop to 116%.

Brighter outlook in 2H 2023

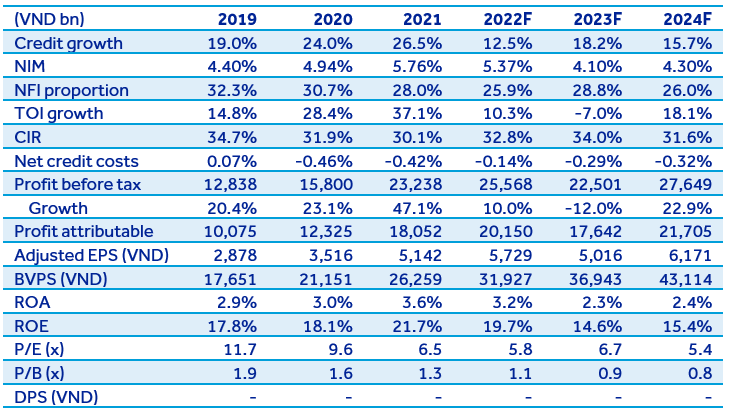

We expect TCB’s NIM to start recovering from Q3/23 and full-year 2023’s NIM at 4.1%, 127 bps lower than 2022. We expect 2024’s NIM to continue to recover 20 bps to 4.3% supported by falling cost of funds and CASA’s rebound.

The management believes that the arising of NPLs will continue, however, the growth rate will be slow. We forecast credit costs to come at 0.5% in 2023 and 2024, up from 0.4% in 2022.

We forecast TCB’s PBT will reach VND22,500 billion for the whole year of 2023, down 12% compared to 2022 (AGM plan: VND22,000 billion). For 2024, PBT is forecasted to recover more strongly, reaching VND27,600 billion, up 23% compared to 2023, mainly thanks to the recovery of NIM.

Valuations & Recommendations

We reiterate our recommendation to BUY with a 1-year target price of VND43,000 per share using a discounted residual income method. Our target price is equivalent to 1-year forward P/E and P/B of 7.6x and 1.1x respectively.