FLASH NEWS 28/02/2025 – Novaland’s 4Q2024 Analyst Meeting

28/02/2025 - 4:57:10 CHNovaland (HOSE: NVL) held 4Q2024 Analyst Meeting on 02/27/2025 with the following highlights:

Potential reversal of provision from paid land use fees for the Lakeview City Project, but the specific amount remains undisclosed. Specifically, after the HCMC announced the decision on determination the land use fees difference value between the two land plots Lakeview City and 30.2ha Binh Khanh in December 2020, NVL paid additional VND53 bn in land use fees related to the Lakeview City in 2016. However, under Resolution 170/2024, there may be adjustments to the amount NVL is required to pay. As a result, starting from April 1, 2025, the total land use fees payable for the project will be reassessed. However, the exact amount has not yet been determined, as further guidance from the government is still awaited for the implementation of the Resolution.

2024 Results: Revenue was USD330 mn (+90% YoY) and loss after tax was USD172 mn mainly due to provision for land use fee payment for the Lakeview City according to land price table of 2017.

Sales performance: NVL sold 347 units with a total value of USD111 mn in 2024. Accumulatively at YE2024, NVL have sold over 44,900 units with a total value of USD12.2 bn and unbilled revenue of USD8.8 bn. For Aqua City, there are over 3,600 units unsold units with a total value of over VND97 trn.

Financial status: At YE2024, NVL had total debts balance of VND61.2 trn, up by 5% YoY mainly due to higher local bank loans. Of which, around VND36.4 trn will be due in 2025, VND6.8 trn due in 2026, VND11.8 trn in 2027 and the remainder will be due after 2027. According to NVL, local banks continues to support the company in terms of debt restructure and offer VND18 trn of credit line for construction. Regarding foreign debts, NVL will continue to negotiate with lenders to delay maturity date by 2-3 years. For local bonds, the company will continue to negotiate with lenders to delay maturity date by 2-3 years and/or convert bond balance to real estate, etc.

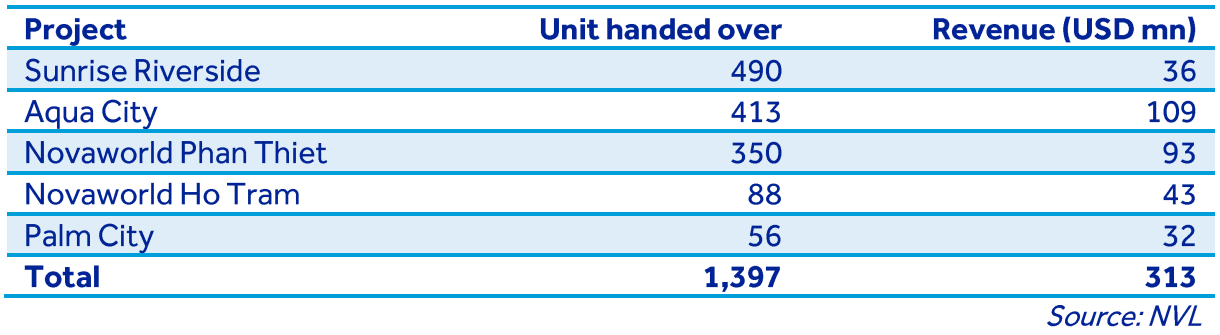

Projects handover: In 2024, NVL handed over nearly 1,400 units and recorded revenue of USD313 mn.

The details of handover in 2024 are as following:

Remaining receivables from sold units: VND98 trn of remaining receivables from sold units, of which NVL expects to collect VND13.7 trn in 2025 and the majority in 2026. For Aqua City, remaining receivables at YE2024 was VND62.7 trn.

2025 outlook:

New launch: For 2025, the company plans to launch around 500 units from ongoing projects, Park Avenue (expect to have construction permit in March 2025 and launch in June 2025) and high-rise component of Palm City (expect to have construction permit in June 2025 and launch in 3Q2025).

Home ownership certificates: In 2025, the company expects to issue over 6,900 home ownership certificates in HCMC at Sunrise Riverside (3,007), The Sun Avenue (2,894), Kingston Residence (406), Orchard Garden (246), Lucky Palace (208) nand Sunrise City North (170).

2025 Targets: Novaland set revenue target at USD836 mn (+153% YoY) and NPAT at USD58 mn which does not include expected reversal of provision from Lakeview City project.

2025 Capex: NVL expects to spend VND11 trn for construction. Decision on land use fees for Novaworld Phan Thiet is expected to be approved in 2Q2025 and NVL plans to pay the land use fees in 2025.

2025 Delivery: NVL expects to deliver over 3,000 units in 2025, 12,200 units in 2026 and 6,900 units in 2027.

Comment: The Resolution 170/2024 which will take effect from April 1st 2025 is expected to remove some obstacles in project approval process for Novaland in specific and for the residential property sector in general. We expect the company will gradually recover from its financial difficulties and accelerate construction in key projects from 2Q2025 given remaining receivables from sold units, VND18 trn credit line from local banks for construction and expected reversal of provision for Lakeview City. We expect the residential property sector will recover faster in 2025-2026 compared with 2023-2024, however, the recovery pace is not evenly distributed among developers and it is likely that presales of healthy and qualified developers will improve in this year while those of weak developers may not see significant improvement.