FLASH NEWS: IJC’s 2025 Annual General Meeting (AGM)

11/04/2025 - 3:33:24 CHBecamex Infrastructure Development JSC (HOSE: IJC) held its 2025 AGM on 04/09/2025 with the following highlights:

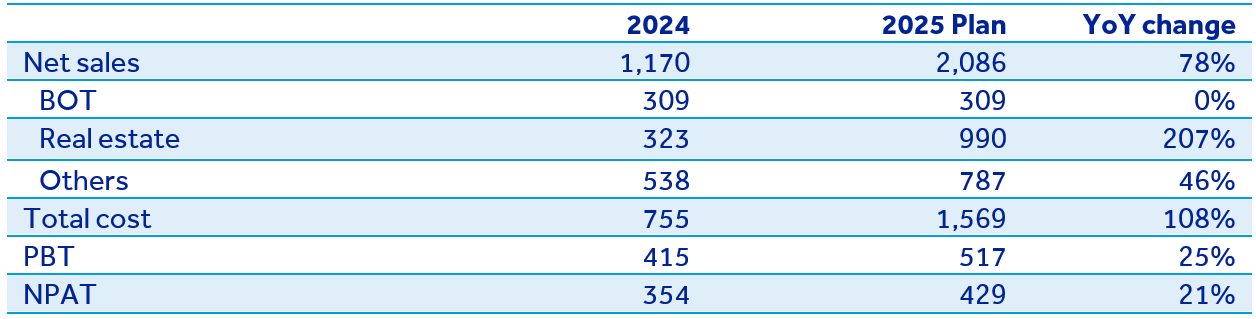

1. 2025 Business Plan: IJC set a consolidated revenue target of VND2,086 bn, (+78% YoY). Pre-tax and post-tax profits are projected at VND517 bn and VND429 bn, respectively, marking increases of 25% and 21% compared to 2024. Notably, revenue from the real estate segment is forecasted to reach VND990 bn (+207% YoY). Key projects to be developed include Sunflower II Villas, Hoa Loi Residential area, Prince Town II, Hoa Loi project, and IJC Aroma Apartments.

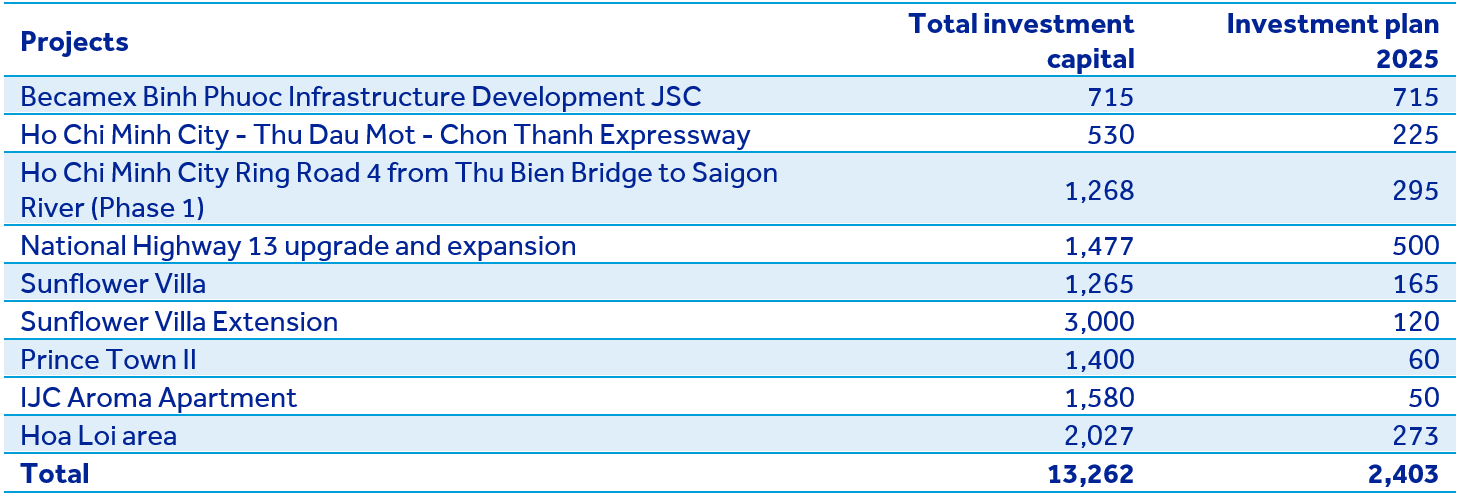

2. In 2025, IJC plans to invest a total of VND2,403 bn in projects detailed below.

3. Capital raising plan: IJC approved a plan to issue over 251.8 mn shares to existing shareholders at a ratio of 3:2 with an offering price of VND10,000 per share to raise VND2,518.3 bn during 2025–2026. Upon successful issuance, the company’s charter capital will increase from VND3,777 bn to VND6,295 bn. The proceeds will be allocated for investments in BOT projects National Route 13, real estate developments, the HCMC – Thu Dau Mot – Chon Thanh expressway, equity contributions to Becamex – Binh Phuoc Infrastructure Development JSC, and repayment of principal and loan interest.

4. Dividend Plan: Dividends for 2024 are set at 5% in cash, with disbursement scheduled for 4Q2025.

5. Strategic plan for 2026–2027:

+ Land bank expansion: Acquiring land from Industrial Investment and Development Corporation – JSC (HOSE: BCM) and Becamex Binh Phuoc.

+ Infrastructure projects completion: Finalizing and operationalizing the National Route 13 (expansion project), alongside investments in key projects such as Ring Road 4, HCMC (Thu Bien Bridge – Saigon River, Phase 1) and HCMC – Thu Dau Mot – Chon Thanh Expressway.

+ Revenue diversification: Increasing the share of income generated from financial investments and toll collection activities.

Quick comment: We believe that IJC exhibits considerable growth potential which is supported by its clean land bank of over 50 hectares in Binh Duong and synergies from BCM’s ecosystem. The ongoing development of infrastructure, especially in Binh Duong, prioritized by local authorities, serves as a significant growth driver for the company. However, capital raising through share issuance poses dilution risk which will potentially impact shareholders’ interests.