TECHNOLOGICAL AND COMMERCIAL JS BANK (TCB)

We raise our target price by 15% to VND 38,200/share due to (1) increasing our TCBS IPO valuation multiple from 3.0x to 3.5x BVPS and (2) rolling forward our target price to July 2026. However, we downgrade our rating from BUY to OUTPERFORM, as TCB’s share price has already rallied 36% since our previous report. We expect TCBS’s IPO in early 2026 and a recovery in the real estate market to serve as key catalysts for TCB’s share price in the coming time.

TCB’s Q2/25 results were quite positive, with PBT rising 9.2% q/q and 0.9% y/y. Growth was driven by credit expansion and effective control of both OPEX and provisioning expenses.

Credit growth remained robust at +11.1% YTD and +19.8% y/y, driven by real estate development loans (+15% YTD) as major developers such as Vinhomes and Masterise launched large-scale projects. NIM rebounded 24 bps q/q after three consecutive quarters of decline, although still 88 bps lower y/y, thanks to improved lending yields.

NFI fell 8.5% y/y due to continued weakness in payment fees, but IB fees, FX, and bancassurance performed well. In early Q3/25, TCB established TCLife, a life insurance subsidiary (VND1,300 bn charter capital; 80% owned by TCB), to distribute insurance products directly to its customers.

OPEX were well-controlled, -3% y/y, keeping CIR at ~30%, a good level in the sector.

Provisioning expenses dropped 38.3% y/y thanks to stable asset quality. NPL ratio inched up 8 bps to 1.26%, while special mentioned loans fell sharply by 19 bps to 0.6%. NPL coverage remained solid at 107%. Interest collection days improved to 52 days, down from the peak of 80 days in Q3/24, indicating easing pressure from potential problematic loans.

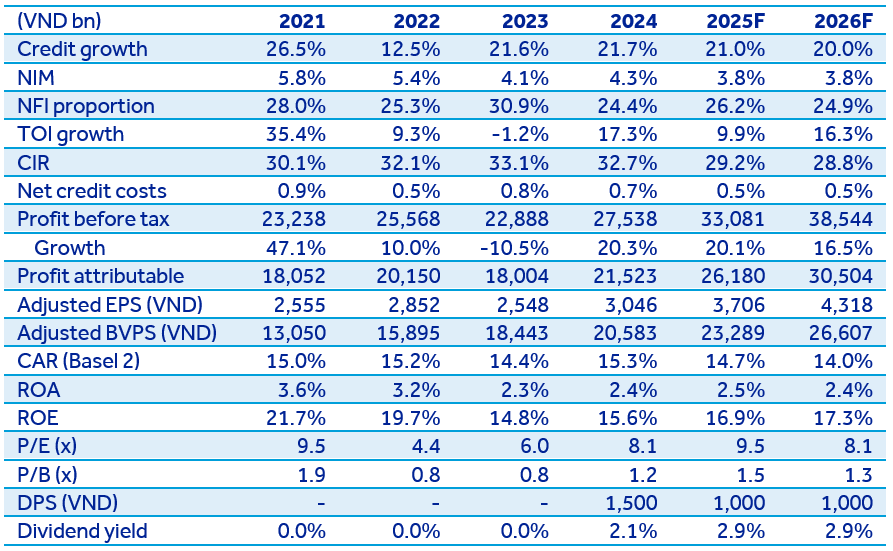

For FY2025, we forecast PBT of VND33,081 billion, up 20.1% y/y (+12.7% y/y excluding last year’s Manulife upfront fee refund). Key assumptions include:

- Credit growth of 21% y/y, with NIM declining 45 bps to 3.82%, resulting in NII growth of 7.4% y/y. NFI is expected to flat, leading to TOI growth of 9.9% y/y.

- OPEX to decline 2% y/y, bringing the CIR down to 29.2% from 32.7% in 2024.

- Provisioning expenses to fall 14.5% y/y thanks to well-contained NPLs. NPL coverage expected at a healthy 116%.