QTP Flash note – BUY

24/10/2023 - 9:24:20 SAQuang Ninh Thermal Power JSC (UPCOM: QTP)

QTP posted earnings results for Q3/2023. Accordingly, revenue was VND2,507 bn (-20.2% yoy), gross profit was VND62 bn (-73.6% yoy) and NPAT was VND12 bn (- 91.8% yoy). Accumulated 9M2023, NPAT reached VND404 bn, completing 91.8% of the company’s plan.

Q3/2023 revenue reached VND2,507 bn (-20.2% yoy and -32.4% qoq). During the climax of the annual rainy and storm season in Vietnam, which typically occurs in the 3rd quarter, thermal groups experience their least favorable situation, resulting in the lower electricity full market prices (FMP), which ultimately diminish the profit margin. We had anticipated a rise in the FMP in light of the EL NINO conditions counterbalance; nevertheless, the output of mobilized hydropower remains unexpectedly high in Q3/2023, resulting in the average FMP price falling by 29.8% yoy to 1,082 VND/kWh. As a result, the proportion of electricity amount that QTP sold in the competitive market has been influenced as well.

COGS decreased by -15.9% qoq and -28.3% yoy, to VND2,444 bn. Besides, the average coal input price was over VND2 mil /ton in Q3/2023, an increase of +38.3% yoy, resulting in a gross profit margin of 2.5%, the lowest level since Q3/2020.

Q3/2023 financial expenses continued to decline; specifically, decreasing to VND28.7 bn (-54.8% yoy). For 9M2023, accumulated financial expenses was VND64.3 bn (-60.1% yoy). This is primarily attributable to the significant decline in interest expenses, (9M2023: -51.6% yoy). In addition, QTP’s debt balance was VND716 bn by the end of Q3, decreasing VND376 bn compared to the beginning of the year.

For Q3/2023, management expenses remained relatively stable at VND23.3 bn (+5.8% yoy). Accumulated 9M2023, total management expenses reached VND67.37 bn (-35.0% yoy).

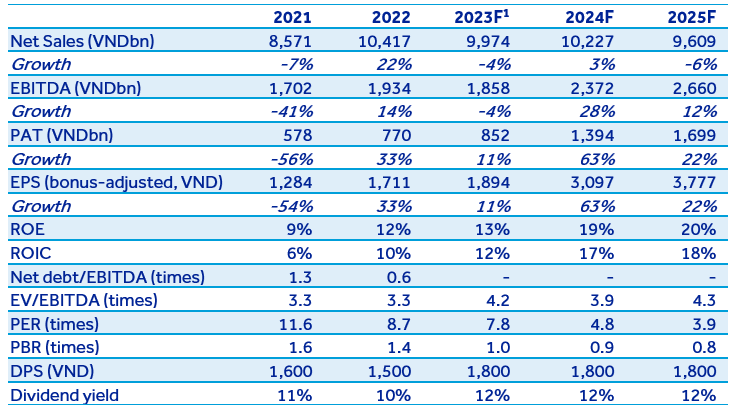

Quick comment: Q3/2023 NPAT reached 91.8% of QTP’s plan and reached only 47.4% of our forecast. We are reassessing adverse factors affecting QTP, including rising coal input prices, and higher than anticipated mobilized hydropower. In the subsequent report, we will present our adjustments for earnings forecast and valuation for 2023 and 2024.